Aline Benchmark Report Update: Results From Q3 2024

Improve your senior living sales and marketing performance with insights from the Aline Benchmark Report Q3 2024.

Improve your senior living sales and marketing performance with insights from the Aline Benchmark Report Q3 2024.

As you work toward ending the year on a high note, we’re here to continue delivering the essential insights necessary for you to achieve and exceed your sales and marketing goals. Building on the in-depth 2023 Aline Benchmark Report for Senior Housing, we’re excited to unveil the Aline Benchmark Report Q3 2024, featuring the most recent data to help you maintain a competitive edge.

The Aline Benchmark Report provides unmatched comprehensive and detailed coverage with data from 309,000 industry-leading senior care units, establishing itself as the premier resource in the sector. Given the distinct market dynamics across independent living, assisted living, memory care, and life plan communities, the report offers a separate analysis for each care type.

To see the complete breakdown of the industry’s sales and marketing data, download our Aline Benchmark Report 2023. Let’s now take a closer look at Q3’s performance.

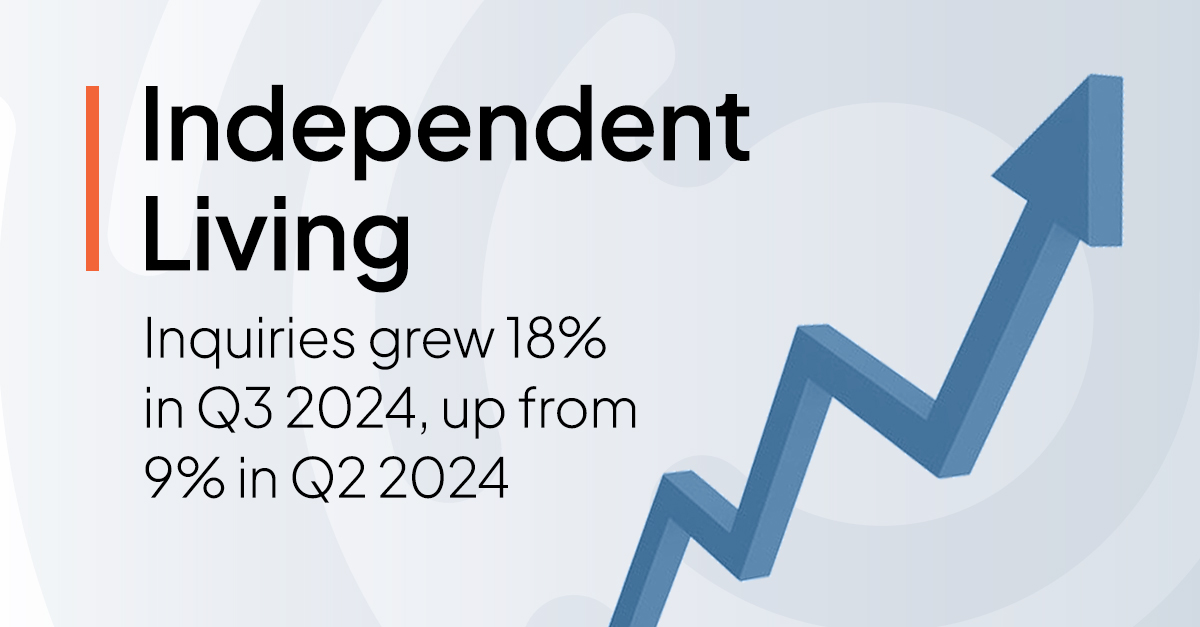

Once normalized for 100 units per month, average inquiries increased the most for independent living, mimicking the same trend from both Q1 and Q2 2024. Back in Q3 2023, inquiries averaged 38 but rose to 45 in Q3 2024.

Along with independent living, assisted living and memory care experienced an increase in inquiries while they slightly dropped for life plan residential. Move-ins and tours held relatively stable with just small changes.

To enhance your analysis of performance, we categorized our conversions into the following segments:

For the average inquiry-to-tour conversions among all segments, memory care was the only community type to experience an increase, from 33% to 35%. Assisted living and life plan residential remained unchanged at 29% and 30%, respectively, while independent living slightly dropped from 30% to 29%.

Evaluating your performance metrics within a regional framework is essential. Differences in population densities and varying degrees of competition make it unrealistic to apply uniform performance standards across diverse regions.

In Q2 2024, move-ins for memory care communities in rural markets dropped year over year, but in Q3 2024, move-ins improved from eight to 11 for a 38% increase. This was the biggest fluctuation in move-ins among the two markets and four care types.

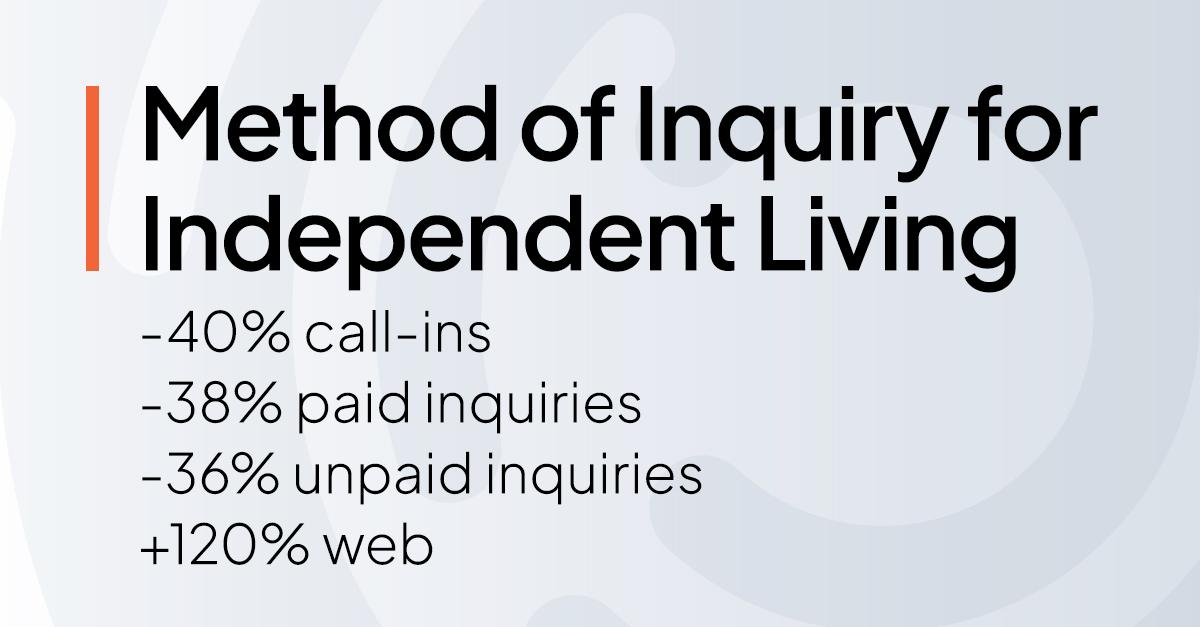

In this report, we looked at the percentage of inquiry methods for call-ins, paid inquiries, unpaid inquiries, and web. For assisted living, memory care, and life plan residential communities, the inquiry methods either remained the same or moved very little. Independent living, however, experienced notable fluctuations.

Are you ready to leverage this data effectively? Head over to our Aline Benchmark Report center where you’ll discover a wealth of resources tailored for enhancing your senior living operations.

In this hub, Erin Hayes, president of Aline, provides her expert insights through an engaging four-part video series. Dive into these videos to learn how to:

Additionally, you’ll gain invaluable insights from industry expert, Jayne Sallerson, president and COO of Charter Senior Living. In her interview, she discusses how leveraging benchmark data can lead to increased resident retention and more sustainable growth for your community.

For the most up-to-date senior living sales and marketing data, download the Aline Benchmark Report Q3 2024 today. And if you missed any past reports, you can find them here: