Senior Living Management: 3 Dos and Don’ts for Revenue Growth

A look at how advanced data and technology can protect revenue and cash flow for senior living management.

A look at how advanced data and technology can protect revenue and cash flow for senior living management.

Published on: May 29, 2024

Last updated: September 4, 2025

For senior living management, navigating the complexities of revenue growth is more than a financial challenge — it’s essential for sustaining high-quality care. Investors might focus on ROI, but the true pressure extends beyond meeting monthly financial targets.

Proper revenue growth is crucial for maintaining properties, offering competitive salaries to reduce staff turnover, and expanding vital resident services. When these deficiencies compound, your care will ultimately suffer. Not only does this damage your standing as a trusted community partner but it could also lead to severe health outcomes for your residents.

Given these high stakes, senior living operators cannot afford to rely on outdated or ineffective revenue cycle management practices. In this blog, we’ll explore the most effective strategies and solutions for enhancing your community’s revenue, ensuring it operates safely and efficiently.

Let’s dive into the dos and don’ts that can help secure a prosperous future for your community.

Adjusting your rates is essential for your profitability, but manually communicating these rate changes is tedious and error prone. This becomes even more complex if you operate across multiple states, each with its own regulatory requirements for notice periods. Mistakes in this area can lead to substantial fines and cut into your revenue growth.

And then there’s the process of executing rate change communications, which is far from quick and simple. Manual rate change communication often takes up to a month to complete. Instead of focusing on strategic initiatives that could drive additional growth, your billing team may find themselves buried in administrative tasks.

Enter automated rate change management. This technology streamlines the entire process by incorporating state-specific requirements directly into the system to protect your revenue and drastically reduce time spent on manual communications. What used to take nearly a month only requires a few days, freeing up your team to concentrate on more impactful business strategies.

Managing payments and dealing with those slow processing times is one of the biggest frustrations for residents, their families, and operators alike. With many of today’s digital payment platforms, consumers expect convenience and efficiency. Providing streamlined payments is critical for retention, and instant leasing approvals can help your acquisition efforts.

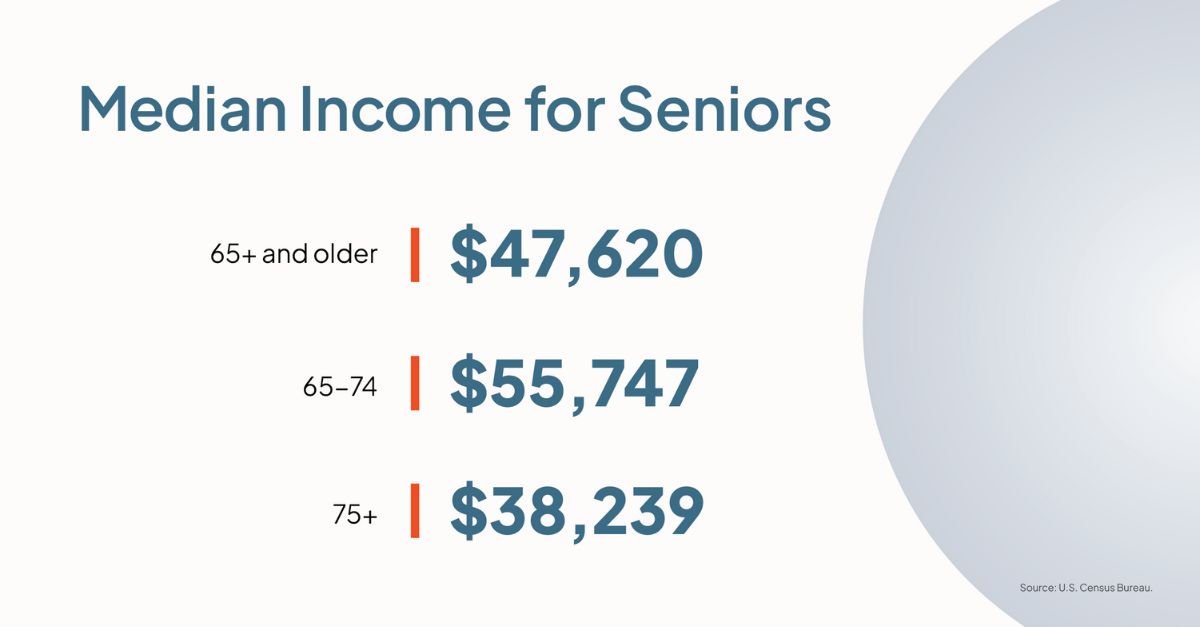

Offering split payments is an especially popular feature in today’s platforms. According to the U.S. Census Bureau, the median income for seniors of varying age groups ranges from $38,239-55,747.

At these fixed income levels, many seniors rely on family members to fully or partially cover their bills. Instead of taking days to transfer funds or write reimbursement checks, a family member or other responsible party can make a payment on the resident’s behalf.

On the operator side, you need quicker processing to ensure cash flow — this is essential for maintaining and growing your property’s operations. Real-time billing also reduces a traditionally unreliable, labor-intensive administrative process. If an error shows up on a bill, not only does this cut into your cash flow and burden your billing team to correct the issue but it can also lead to unhappy residents. Over time, resident dissatisfaction can lead to bad reviews, fewer referrals, and increased move-outs, all of which will hurt your occupancy rates and ultimately revenue.

Related: See how English Meadows saved its billing coordinator two days of administrative work with quicker ACH payments and processing.

Your residents’ needs often fluctuate — from their changing care requirements to financial situations and even amenity preferences. These fluctuations can lead to unstable occupancy rates, making it difficult to manually track scheduled move-ins and move-outs, identify vacant rooms, and set housing and care pricing.

Implementing a census management system can transform how you handle these challenges. A census management system automatically updates your back office with real-time data on community inventory and pricing. Equipped with this information, your team can:

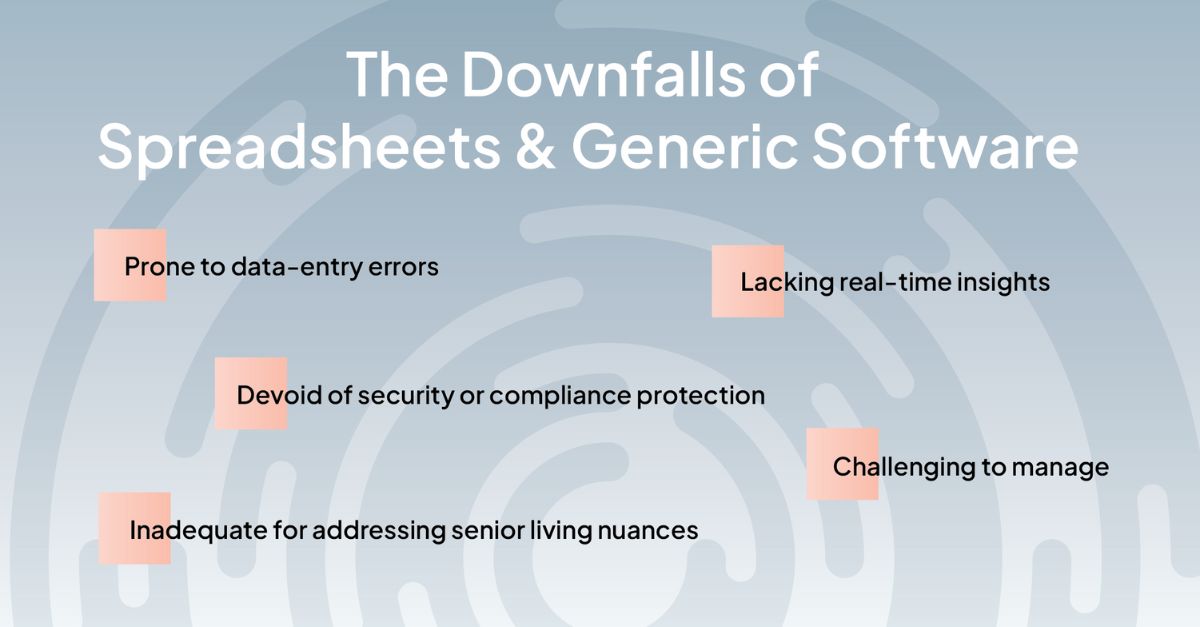

Spreadsheets are notoriously prone to human error. A simple misplaced decimal can significantly skew data on your occupancy rates, financial forecasts, and other critical metrics. As your data grows, navigating through spreadsheets can become increasingly challenging, compounding the likelihood of errors.

On top of errors, spreadsheets lack real-time data and insights, which are essential for effective senior living management. Leveraging current data is crucial when making decisions regarding resident care, marketing strategies, or operational adjustments. Delays in accessing up-to-date information can prevent your community from capitalizing on opportunities for improvement or addressing issues promptly, potentially leading to revenue losses.

Spreadsheets and generic software also do not offer the right security features to protect sensitive resident information and ensure compliance. Of course, these can lead to hefty fees that directly cut into your revenue.

By transitioning to dedicated senior living management software, you can overcome these limitations. Automated data integration helps eliminate manual errors for better data accuracy. Real-time data updates empower timely decision-making while built-in security and compliance features protect resident information and help avoid legal penalties.

Efficient and cost-effective senior living management requires an integrated, cross-functional approach. Consider how these pieces fit together and can affect revenue if not properly managed.

Supplemental payor systems, such as insurance and government assistance programs, require precise handling to ensure compliance and accurate billing. However, manually managing these systems often leads to incorrect data entry, delayed claim submissions, or missed billing updates. In turn, supplemental payor systems can deny those claims or delay payments for a direct hit on your cash flow.

Manual supplemental payor management is also slow and inefficient when coverage changes. Following a coverage change, the billing team needs to immediately update the resident’s new payment information, but staff are often too burdened to capture this change immediately. This gives you an inaccurate view of your financial data, which can lead to misinformed operational decisions.

However, automated supplemental payor management improves billing accuracy and compliance with real-time updates to your claims processing and financial reporting. In addition to reducing the administrative burden, minimizing errors and disruptions can lead to quicker claim approvals, safeguarding your revenue stream.

Despite the complexities you face in senior living management, the Aline software suite makes it simple to connect every aspect of your business — from accounting and billing to sales and marketing, resident care, and operations. With this integrated view, your different departments can easily and efficiently share the right insights to make more informed financial decisions.

If you’d like to learn more about how Aline’s integrated solution works to protect your bottom line, book a demo today or download our helpful guide on better managing revenue workflows for senior living.

Amanda McGrory-Dixon

Amanda McGrory-Dixon is the content marketing manager at Aline, where she shares expert insights on how senior living communities can streamline operations, enhance resident satisfaction, and drive sustainable growth. With a deep understanding of industry trends and technology, she helps operators navigate challenges and implement data-driven strategies to improve efficiency, profitability, and care outcomes.

Blogs, stories and studies from the forefront of senior living operations

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Prospect-centered selling helps senior living operators convert more leads and achieve occupancy goals through a more personalized, empathetic approach.

Gain insight into senior living pricing strategies for community success. Explore how Aline’s software optimizes revenue and operations

Overcome the biggest senior living financial challenges, including operational costs and occupancy rates, with interconnected software

Take a look at how senior living software options, like Aline, can elevate operations, resident care, and ROI

Enhance efficiency, accuracy, and resident satisfaction by integrating a POS system into your senior living dining operations

We’re using cookies on this site to improve your experience. Cookies help us learn how you interact with our website, and remember you when you come back so we can tailor it to your interests.

You can find out more about cookies and usage on our cookie policy page.

Some of these cookies are essential, while others help us to improve your experience by providing insights into how the site is being used.

For more detailed information on the cookies we use, please check our privacy policy

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Aline Innovation Summit 2026: Registration Now Open!

Connect with senior living leaders, innovators, and industry peers May 11-13, 2026, in Frisco, TX to explore the latest innovations, proven strategies, and best practices shaping the future of senior living. View details and register today.