Crush Your Senior Living Marketing Goals With Lead Generation Surveys

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Published on: September 16, 2025

Last updated: October 22, 2025

For most senior living operators, maintaining steady occupancy rates ranks as a top concern, particularly in today’s economic climate. In fact, 54% of respondents in Aline’s 2025 State of the Senior Living Industry Report identified lead generation and personalized outreach as their top priorities for achieving growth.

Lead generation surveys make personalized outreach easier by giving you a clearer picture of your prospects’ interest levels and financial situations. Given that more than 17 million older adults over 65 are economically insecure, according to the National Council on Aging, this is especially critical. To maximize results, marketing practitioners should focus their time and resources on the leads most likely to move in.

Surveys also offer a cost advantage. Compared with events or referral programs, acquiring leads through surveys and web forms is significantly more affordable. When operators use surveys not just to gather information but to act on it, they can better target qualified prospects and keep occupancy rates strong.

When families visit your website or call about senior living options, they rarely share the details you need to truly help them. Whether embedded in contact forms or sent after the first interaction, lead generation surveys provide the missing context you need to better inform your marketing and sales strategies.

Here are some of the key benefits.

In fact, senior living operators using Aline Roobrik Surveys say they get an additional 20% to 40% web leads and 20-plus data points that make converting them faster and easier. Such leads are also known to convert at up to two times the rate of standard web inquiries.Brightview Senior Living, for example, saw a 33% incremental increase in leads from web traffic in 2023 after the team started using Roobrik Surveys. Mike Thompson, director of marketing at Brightview, considers surveys “the unbiased nudge prospects need” to make decisions.

Lead generation surveys act as a form of non-invasive discovery. Instead of your sales team pressing for answers, prospects naturally share what matters to them. In turn, your team gains the clarity and confidence they need to guide conversations toward the right solutions.

Depending on your sales goals, surveys can reveal a prospect’s readiness for change, care preferences, living situation, and even family dynamics. Here are some of the most valuable areas to explore.

The most effective lead generation surveys are empathetic. Not only does this help you identify qualified prospects but it also guides families through a respectful, informative process that makes it easier for them to recognize when they’re ready to take the next step.

Here are some best practices for creating surveys that convert.

For inspiration, we created a sample “4-minute” senior living survey, featuring close-ended, multiple-choice questions with prompts that explain why each question matters and what prospects should consider before answering.

The value of your lead generation surveys lies not just in the data collected but in how you put that data to work. In fact, 32% of respondents in Aline’s 2025 State of the Industry Report said they plan to improve their sales processes to boost lead conversion rates, underscoring the importance of execution.

Here are some practical ways to turn insights into results.

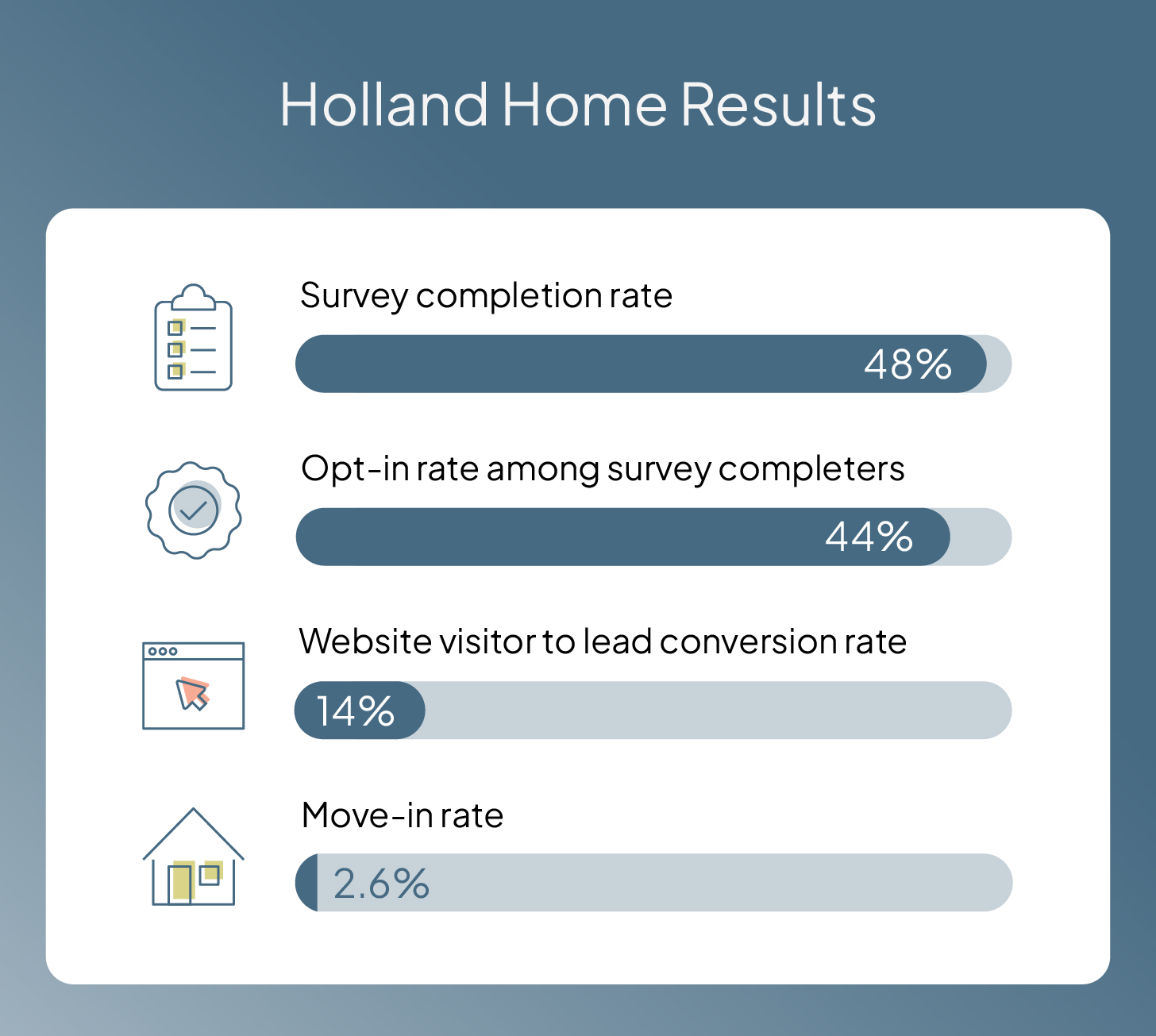

Holland Home, a continuing care retirement community (CCRC), faced a familiar challenge: how to engage website visitors who were actively researching senior living options but not yet ready to speak with sales. This “hidden audience” often slipped through the cracks of traditional lead generation methods.

In 2023, Holland Home integrated Roobrik decision-support surveys on its website. This gave families a comfortable, low-pressure way to share sensitive details, such as finances and care needs, before any direct interaction with sales.

Within a year, Holland Home generated 150-plus Roobrik-qualified leads and secured four CCRC move-ins directly attributed to the platform. Holland Home’s survey performance also outpaced Roobrik’s industry benchmarks:

Here’s what Michael Loughman, vice president of sales and brand marketing for Holland Home, said:

“With Roobrik, our team starts with momentum. We already know a prospect’s timeline, care needs, financial situation, and motivations before we pick up the phone.”Michael Loughman, Vice President of Sales, Holland Home

The success has been so significant that Holland Home now uses survey data not only for immediate sales conversations but also to shape its long-term lead nurturing strategies.

For senior living providers, lead generation surveys offer a non-intrusive way to create empathetic, resident-focused sales conversations. Over time, this translates into higher occupancy rates and greater resident satisfaction.

Roobrik Solutions by Aline makes this possible with surveys built on motivational interviewing techniques. The result is a low-pressure experience that guides prospects toward confident decisions — even on sensitive topics like care needs and financial readiness.

Let’s talk about how Roobrik Solutions by Aline can support your prospecting strategy.Want to see how other lead generation strategies can improve your sales performance? Download our guide “Improve Sales Performance With Better Lead Generation.”

Amanda McGrory-Dixon

Amanda McGrory-Dixon is the content marketing manager at Aline, where she shares expert insights on how senior living communities can streamline operations, enhance resident satisfaction, and drive sustainable growth. With a deep understanding of industry trends and technology, she helps operators navigate challenges and implement data-driven strategies to improve efficiency, profitability, and care outcomes.

Blogs, stories and studies from the forefront of senior living operations

Prospect-centered selling helps senior living operators convert more leads and achieve occupancy goals through a more personalized, empathetic approach.

Gain insight into senior living pricing strategies for community success. Explore how Aline’s software optimizes revenue and operations

Overcome the biggest senior living financial challenges, including operational costs and occupancy rates, with interconnected software

Take a look at how senior living software options, like Aline, can elevate operations, resident care, and ROI

Enhance efficiency, accuracy, and resident satisfaction by integrating a POS system into your senior living dining operations

See how emerging dining strategies help senior living communities streamline operations while fostering stronger connections with residents

We’re using cookies on this site to improve your experience. Cookies help us learn how you interact with our website, and remember you when you come back so we can tailor it to your interests.

You can find out more about cookies and usage on our cookie policy page.

Some of these cookies are essential, while others help us to improve your experience by providing insights into how the site is being used.

For more detailed information on the cookies we use, please check our privacy policy

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Aline Innovation Summit 2026: Registration Now Open!

Connect with senior living leaders, innovators, and industry peers May 11-13, 2026, in Frisco, TX to explore the latest innovations, proven strategies, and best practices shaping the future of senior living. View details and register today.