61 Assisted Living Statistics Operators Should Know

Stay up to date with trends to improve business outcomes.

Stay up to date with trends to improve business outcomes.

Published on: April 18, 2024

Last updated: May 22, 2025

Contents

As an assisted living operator, you’re dedicated to creating thriving communities and meaningful connections among your residents. By staying up to date on the latest assisted living statistics and senior living trends, you can improve your business outcomes and optimize the experiences of the residents and families you serve.

In this post, let’s review a list of interesting assisted living statistics every operator should know to help you improve your operations and provide better care.

Grasping the present state of the senior living industry is crucial for operators and stakeholders alike to make well-informed decisions. From workforce dynamics to identifying key opportunities and navigating revenue challenges, these statistics offer a comprehensive overview of the industry landscape.

Here are some current statistics on the state of senior living:

An important aspect of the senior living industry is its workforce, which forms the backbone of everyday operations. Check out these senior living workforce statistics:

One of the biggest challenges in the senior living industry is learning how to improve employee retention. Strategies, like competitive wages, a supportive work culture, and helpful tools that cut down on administrative tasks, can help reduce turnover rates and foster a committed workforce.

These efforts ensure consistent care for residents and higher satisfaction levels and improve the organization’s reputation and long-term success in the competitive market.

The senior living industry faces a dual landscape of significant growth potential and pressing challenges. Check out these statistics of opportunities and challenges in the senior living industry:

While rising demand for long-term care and the projected market expansion present profitable opportunities, senior living management face challenges like meeting occupancy goals and leveraging data effectively.

Strong CRM software is crucial to overcoming these challenges. Integrating a suite of tools for efficient data management further improves decision-making processes, contributing to the community’s success.

The looming financial constraints for middle-income older adults also highlight the need for innovative solutions to ensure accessible and affordable senior housing and care options in the future.

Demographic factors, such as age, gender, race, and cultural background, are pivotal considerations for senior living operations due to their influence on residents’ needs, preferences, and overall well-being.

By accounting for these demographics, you can foster inclusive environments, improve resident satisfaction, and deliver person-centered care that addresses each resident’s unique needs.

Understanding the age demographics within assisted living communities is important for owners and operators to tailor their services effectively.

Assisted living communities cater primarily to older adults with most residents being 85 years old or older.

Operators should prioritize age-appropriate services and amenities to ensure the well-being of residents across all age groups within their communities.

Assisted living communities have a distinct gender gap with a notable prevalence of women compared to men. Women typically outlive men, marking a significant 5.9-year difference in life expectancy.

Gender considerations may guide facility design, roommate assignments, and the delivery of gender-specific care services.

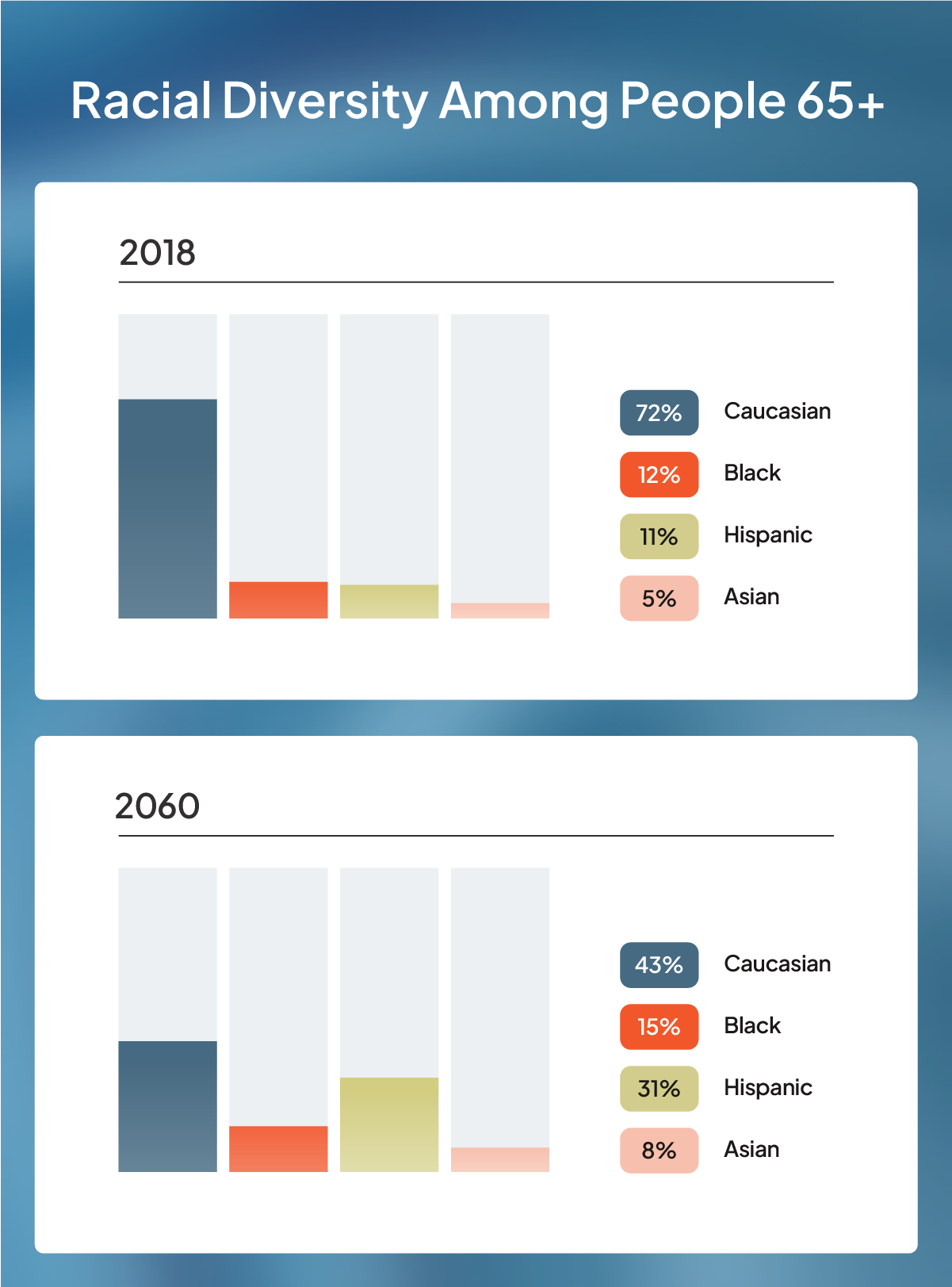

Understanding the ethnic and cultural makeup of assisted living residents is important for providing culturally competent care and fostering inclusive communities. Here are some interesting statistics to keep in mind:

Most current assisted living residents are white, reflecting the demographic composition of the baby boomer generation. Cultural differences, including multigenerational living patterns, also influence the care landscape with nonwhite families being more likely to live in multigenerational households.

As the U.S. population becomes more racially diverse, senior living facilities must adapt to accommodate the changing demographic landscape.

This could include providing culturally competent care and respecting residents’ traditions, dietary preferences, and religious practices. These efforts ensure culturally competent care and foster inclusivity for all residents.

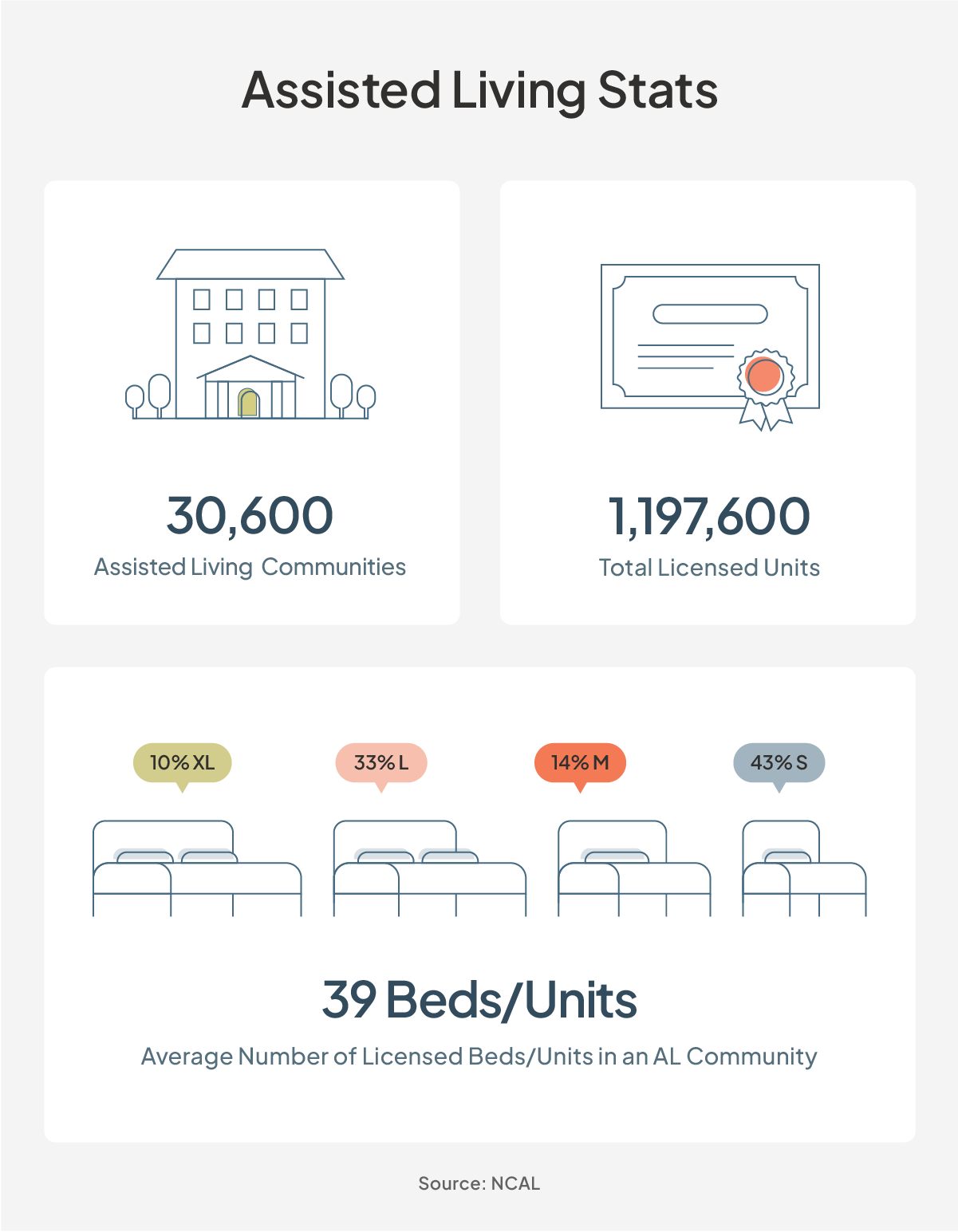

Assisted living operators should know how many seniors live in assisted living communities, including their regional distribution, prevalent daily activities, and health conditions.

This information enables operators to assess the demand for assisted living communities across the United States and tailor services to meet residents’ needs effectively.

Here are a few statistics on the amount of residents in assisted living facilities:

By staying informed about these statistics, you can tailor your offerings to provide the necessary care and support throughout your residents’ stay in your assisted living communities.

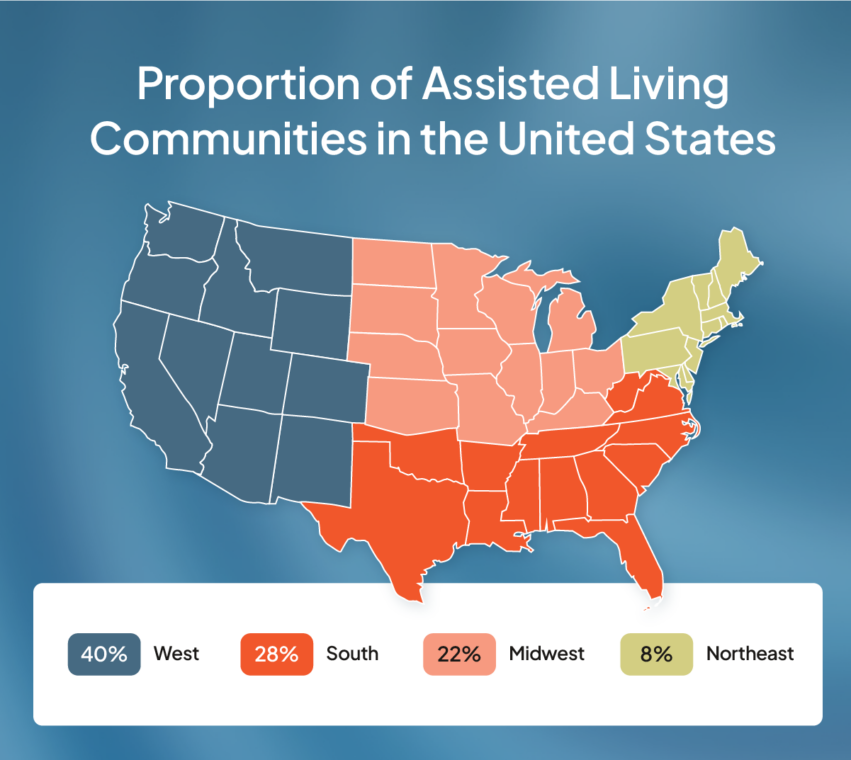

Understanding regional differences is crucial for operators due to the vast geographic diversity across the United States. Here are some statistics on assisted living in different regions.

States with the highest concentrations of assisted living communities often correspond with larger populations of individuals aged 65 and older. This correlation suggests a heightened demand for senior care services in regions with substantial aging populations.

Conversely, states with fewer assisted living communities present potential opportunities for expansion and development within the senior living sector. By strategically targeting underserved regions and adapting services to meet local needs, you can capitalize on emerging market opportunities and provide essential care to aging populations across different U.S. regions.

Various factors contribute to older individuals transitioning into assisted living facilities. Understanding the daily needs and conditions of your residents is important for your community to provide appropriate care.

Some daily activities residents require assistance with include:

Some of the top health conditions residents in senior living facilities have:

Understanding the prevalent needs and health conditions of residents in assisted living communities is essential for delivering tailored care. By addressing these needs, communities can enhance resident well-being and ensure a higher quality of life for their occupants.

Understanding the financial aspect of assisted living is extremely important for operators as it directly impacts operational decisions, resident affordability, and overall financial stability.

These statistics offer insights into the current costs of assisted living, shed light on financial challenges faced by prospects, and provide valuable information on the industry’s internal financial dynamics.

Understanding affordability trends in assisted living is essential as the cost of care continues to rise.

These statistics show the pressing challenge of ensuring affordability and accessibility in senior care, particularly as demand for assisted living rises amidst economic insecurity among older adults.

Understanding statistics on the sales cycle and conversion rates of assisted living facilities is crucial for operators to effectively manage occupancy and boost revenue. Check out some of these interesting statistics on the average sales cycle:

Short sales cycles often occur when dealing with urgent prospects who require higher levels of care and tend to stay for shorter periods, resulting in more frequent move-outs.

To maintain stable occupancy levels, sales teams must focus on attracting more prospects with shorter sales cycles to counterbalance the increasing number of move-outs. Otherwise, the cycle velocity will decline. Robust CRM software is essential for tracking leads throughout the entire sales cycle, especially in cases of longer cycles.

Understanding where you can find potential prospects is crucial for effective marketing strategies. Here are the top five sources of conversions:

Traditional marketing sources have significantly higher inquiry-to-tour conversions, especially among the baby boomer generation. This demographic, more familiar with print media and direct mail, continues to rely on these traditional channels for information.

For more insights into sales and marketing in the senior housing industry, refer to the Aline Benchmark Report.

Monitoring trends and the future in the assisted living industry is crucial for operators to effectively plan for the future and meet the growing demands of an aging population. Here are some key statistics highlighting the importance of monitoring these trends:

Monitoring trends and projections in the assisted living industry is essential for owners and operators to anticipate and meet the increasing demand for senior housing and care services. By understanding demographic shifts and future needs, you can strategically position your facility to provide high-quality care and accommodations for the growing aging population.

Staying informed about assisted living statistics and trends is crucial for operators to effectively prepare for the future. Aline offers a comprehensive solution to navigate the evolving landscape of senior living, helping operators optimize performance, drive revenue growth, and stay ahead in a competitive market.

If you’re interested in more insights, book a demo or check out the Aline Benchmark Report for insights that can help you optimize your performance and drive revenue growth in a competitive market.

Amanda McGrory-Dixon

Amanda McGrory-Dixon is the content marketing manager at Aline, where she shares expert insights on how senior living communities can streamline operations, enhance resident satisfaction, and drive sustainable growth. With a deep understanding of industry trends and technology, she helps operators navigate challenges and implement data-driven strategies to improve efficiency, profitability, and care outcomes.

Blogs, stories and studies from the forefront of senior living operations

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Prospect-centered selling helps senior living operators convert more leads and achieve occupancy goals through a more personalized, empathetic approach.

Gain insight into senior living pricing strategies for community success. Explore how Aline’s software optimizes revenue and operations

Overcome the biggest senior living financial challenges, including operational costs and occupancy rates, with interconnected software

Take a look at how senior living software options, like Aline, can elevate operations, resident care, and ROI

Enhance efficiency, accuracy, and resident satisfaction by integrating a POS system into your senior living dining operations

We’re using cookies on this site to improve your experience. Cookies help us learn how you interact with our website, and remember you when you come back so we can tailor it to your interests.

You can find out more about cookies and usage on our cookie policy page.

Some of these cookies are essential, while others help us to improve your experience by providing insights into how the site is being used.

For more detailed information on the cookies we use, please check our privacy policy

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Aline Innovation Summit 2026: Registration Now Open!

Connect with senior living leaders, innovators, and industry peers May 11-13, 2026, in Frisco, TX to explore the latest innovations, proven strategies, and best practices shaping the future of senior living. View details and register today.