Identifying and Preventing Senior Living Revenue Leakage

Avoid revenue leakage by stopping it before it starts.

Amanda McGrory-Dixon

As operators, you face so many different sources of revenue stress — inflation, staff turnover, and supplemental payor challenges — but senior living revenue leakage can be especially costly in a time when many communities are already struggling.

According to the latest Polsinelli-TrBK Distress Index, health care-related Chapter 11 bankruptcy filings are increasing in 2024. According to the report, the health care distress index is more than 800% higher than it was in 2010, and senior living communities are feeling “intense stress.”

To get ahead of revenue leakage, you need a proactive approach to identifying common causes and the right solutions in place to immediately address those issues. Stopping revenue leakage before it starts is key to protecting your portfolio’s growth.

What Is Revenue Leakage?

Senior living revenue leakage is money your senior living community has earned but lost, either by not collecting the funds or spending your budget on avoidable costs, such as replacing staff or fighting denied claims.

Think of your revenue stream as a pipe. Potential earnings slip away when revenue leaks, like water in a dripping pipe. As a senior living operator, it’s your job to patch those leaks to maximize revenue and reinvest those earnings into your communities to enhance your residents’ experiences and attract new prospects.

If you don’t patch revenue leakage holes quickly, you can face cash flow problems. With limited cash flow, you may have to limit services, which can make you unpopular with residents, or you may have to take out high-interest loans to cover the gap without affecting residents.

10 Common Causes of Revenue Leakage [+ How to Eliminate Them]

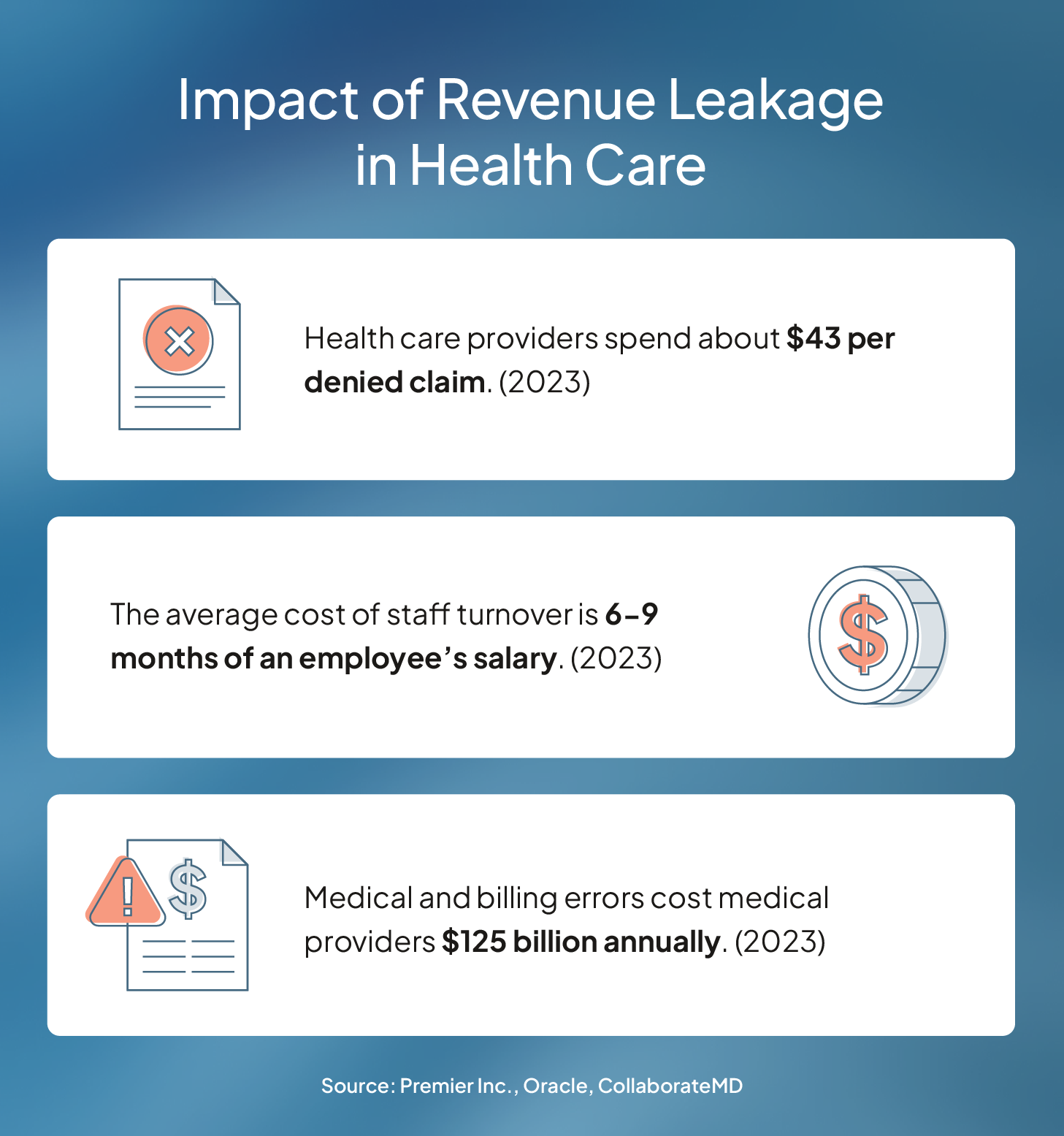

You can’t afford to ignore revenue leakage. According to McKinsey and Company, revenue leakage in health care costs $300 million annually. By nature, this is unseen revenue loss, so it’s important to catch these issues before these numbers creep into your revenue reports.

Here are the most common causes to look for in your senior living community.

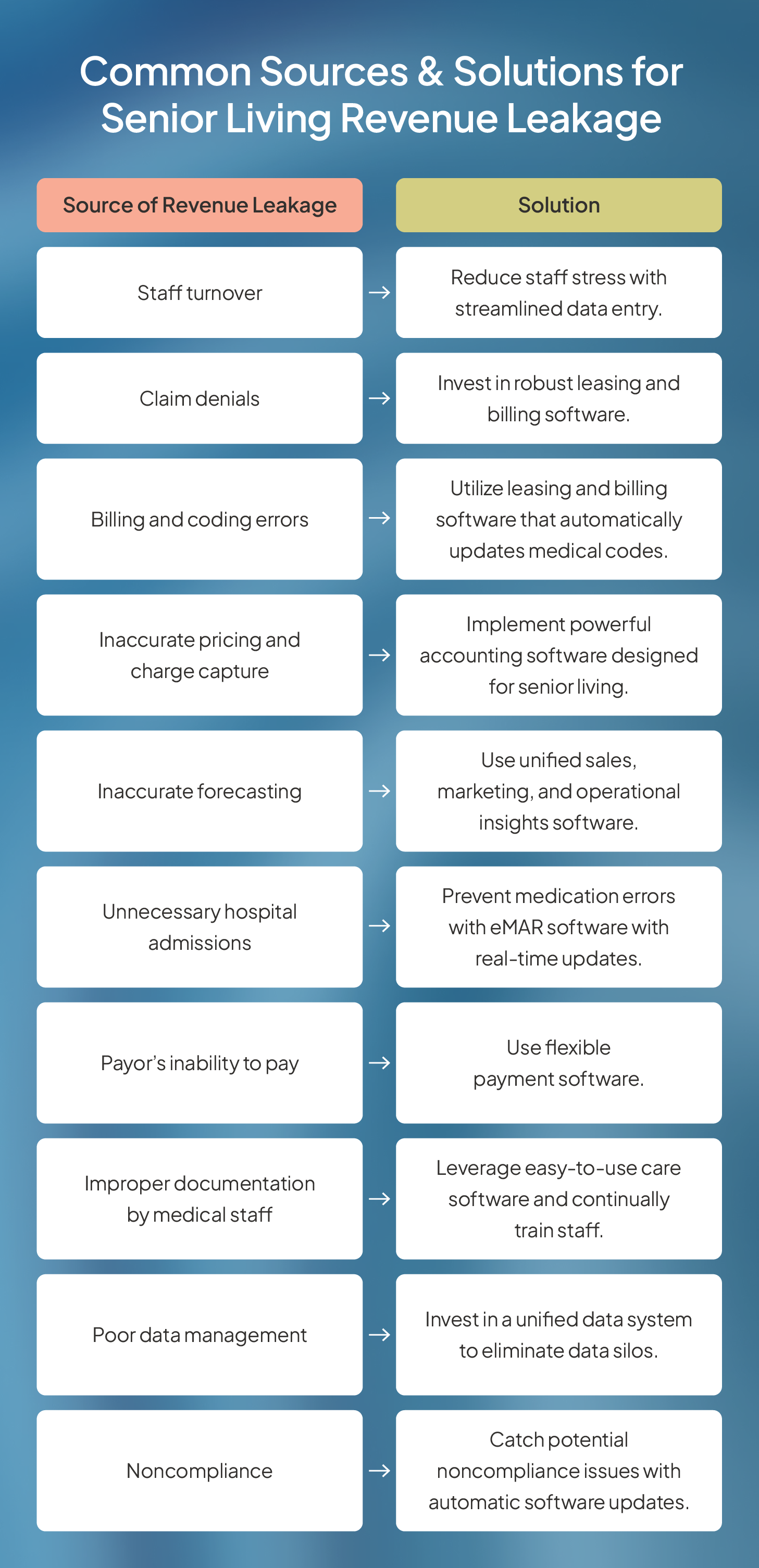

1. Staff Turnover

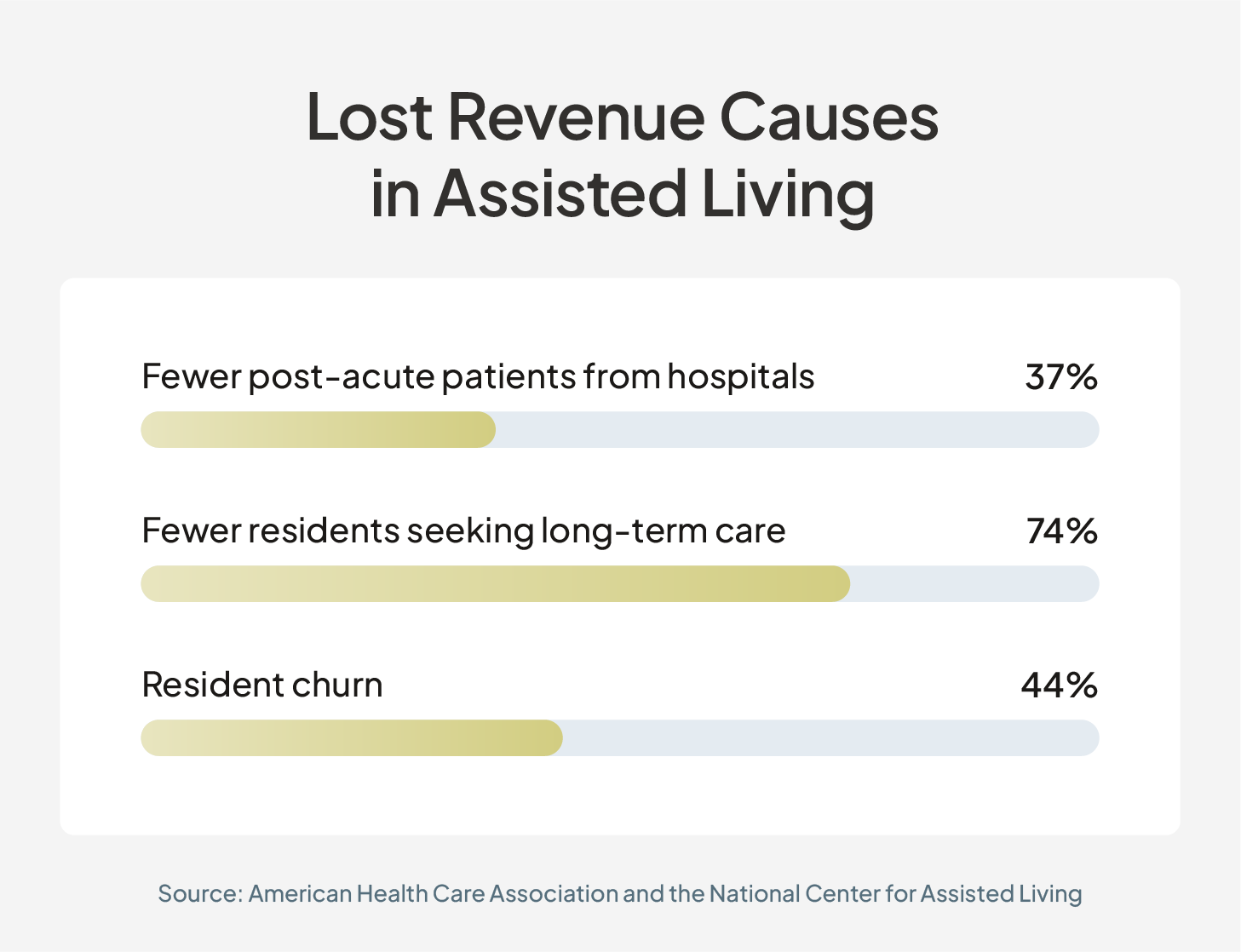

High turnover rates have long troubled the senior living care industry with some assisted living statistics suggesting it’s as high as 50%. This presents a potentially huge revenue leak for operators, making employee retention a top priority.

Staff turnover contributes to revenue leakage in several ways:

- Advertising, interviewing, screening, and hiring a new employee costs money.

- Onboarding the new employee requires training hours from HR and management.

- New employees generally aren’t as productive and effective as long-term employees, leading to lost productivity.

- Staff turnover can lead other employees to disengage and become less effective.

- New hires often make more mistakes than seasoned employees, so you may see increased medication management and administration errors that can potentially harm residents and rack up fines.

- High staff turnover rates can lead others in the field to ask why, which may make hiring new employees more difficult.

- Your remaining staff may have to work extra to cover for employees who have left, potentially impacting their job satisfaction and performance, which can also lead them to quit.

| Success tip: Be proactive about minimizing staff stress, a main cause of turnover. Streamlined care software with real-time updates synchronizes your team, ensuring consistent and informed communication across all members. This advanced technology also minimizes time spent charting, so your care staff can focus on providing high-quality, personalized care rather than data entry. |

2. Claim Denials

Claim denials aren’t just bad for your residents — they also hurt you. In fact, 76% of health care financial leaders list managing claim denials as their most time-consuming revenue cycle task. A Premier study found that private payors deny roughly 15% of claims. Fortunately, more than half of those were eventually overturned, but it costs providers about $43 per claim to fight.

When insurance companies deny claims, the resident must take on the cost. But most seniors are on limited budgets. They either need a payment plan, which reduces cash flow, or they can’t pay back the denied claim.

| Success tip: Invest in leasing and billing software designed specifically for senior living communities that catch billing and coding errors before sending claims. This software also automates the bill collection process and stay on top of prior authorization requirements. |

3. Billing and Coding Errors

Billing, coding, and accounting errors are one of the biggest causes of claim denials, accounting for 42% of all claim denials, according to an Experian survey. Some medical codes are updated annually while others are updated more frequently, which can create confusion for your medical billing and coding team.

| Success tip: Train your billing and coding staff frequently on coding updates to eliminate these costly errors. You can also invest in billing software that automates coding updates to flag errors early in the process. |

4. Inaccurate Pricing and Charge Capture

To remain competitive, you have to price your community competitively. Too high, and you risk losing residents to more affordable communities. Too low, and you can lose valuable revenue to adequately care for your residents.

With senior living rent rate increases occurring every year and rate hikes varying by acuity level, finding the balance is tricky, especially if you have multiple acuity levels in your portfolio.

Add in evolving pricing for medical care and the potential for charge capture errors and it’s easy to see how you could be hemorrhaging revenue without realizing it.

| Success tip: Implement senior living accounting software that allows you to pull reports on pricing and compare them to industry standards to ensure your rent increases are on par with your area. |

5. Inaccurate Forecasting

Accurate forecasting is crucial in senior living management.

Without a precise understanding of future demand, poor decisions can lead to unnecessary renovations or expansions, which directly reduces your profit margins. Similarly, incorrect staffing forecasts not only affect operational effectiveness but can also significantly inflate costs and lead to poor financial performance.

The reliability of every decision hinges on the quality of the data behind it. If you turn to inaccurate forecasting data, expect to make misguided decisions as well. This can result in overstaffing, improper resource allocation, or unprofitable investments — all of which directly impact your bottom line and lead to significant revenue leakage.

| Success tip: Accurate, real-time updates are essential for every senior living operator. By integrating your sales and marketing data with operational insights software, you can make the right decisions to help your community become more competitive. Ultimately, those investments help enhance resident satisfaction to increase occupancy and their lengths-of-stay for more sustainable revenue growth. |

6. Unnecessary Hospital Admissions and Readmissions

Hospital admissions and readmissions not only increase direct care costs but also lead to lost revenue during resident hospital stays.

Communities with high readmission rates, for instance, may face penalties and reduced reimbursements from insurers, including Medicare. These frequent hospitalizations can even result in higher insurance premiums and more rigorous claims scrutiny, complicating reimbursement processes and impacting overall financial stability.

| Success tip: A powerful eMAR system can prevent many hospital admissions and readmissions. This software updates in real time and provides medication reminders and prevents medication errors, which affect 27% of patients in senior living. |

7. Payor’s Inability to Pay

As a senior living owner and operator, you know your residents have limited incomes. The annual median retirement income in 2023 was about $50,000, yet the average cost of assisted living is $4,500 a month. As a result, many seniors cannot afford their medical bills.

Even with insurance, roughly four million adults over 65 report having medical-related debt. This is money you’ve made but haven’t collected.

| Success tip: Offer residents automated, flexible payment systems. Since so many seniors live on fixed incomes, family members often help with the bills in full or partial payments. A system that allows for multiple family members, such as several siblings, to easily split monthly payments helps close the gap on missing funds and reduces the time your staff spends tracking down overdue charges. |

8. Improper Documentation by Medical Staff

Your staff is human and makes mistakes. Improper documentation can happen. Unfortunately, those mistakes may put residents at risk and potentially cost you.

As your medical staff documents a resident’s care, the coding team translates the medical documentation to medical codes. The billing team then uses those codes to create invoices sent to payors. If there’s a mistake during any step of the process, your coding and billing team may not catch it.

| Success tip: Leverage easy-to-use senior living resident care software with real-time updates to keep everyone informed on each resident’s current acuity level without hours of charting. Continually train your care staff on best practices for documentation. |

9. Poor Data Management

One of the biggest examples of poor data management in senior living communities is related to acuity creep. Acuity creep occurs when a resident loses the ability to live at their current level of care.

For example, a resident may fall and require guided assistance until they heal. However, that change in care — and its related costs — isn’t automatically communicated to billing unless a unified system is in place. As a result, you end up providing more expensive care without billing for it, which could go undiscovered for months.

| Success tip: To remain objective in their assessments, caregivers aren’t involved in billing, but the back office still needs to immediately record any new changes in care. Ensure your tech stack automatically communicates care changes to give the billing team the correct rates while allowing the care team to provide appropriate care. |

10. Noncompliance

The senior living industry is constantly evolving with changes to medical treatments, medical codes, insurance billing practices, and laws and regulations. These fluctuations leave the potential for noncompliance wide open unless you stay on top of these changes day to day and communicate any changes to your staff.

Noncompliance has the potential for expensive repercussions. Not only is it dangerous for your residents but it can also leave you open to costly fines and potential lawsuits. Even one noncompliance event can harm your reputation if a resident or family member mentions it in an online review, which could harm your lead pipeline for future occupancy growth.

| Success tip: Senior living operations software can help you stay on top of compliance issues — from medication administration to resident care. Some software can flag noncompliance with real-time alerts to always keep your team in compliance. |

How to Identify Revenue Leakage

In the past, identifying revenue leakage involved in-depth, time-consuming data analysis across all your platforms. However, software can do much of this analysis easily and instantaneously.

To identify revenue leakage in your senior living portfolio, follow these steps.

- Hypothesize the source: Consider what might be causing the issue and pinpoint specific areas where you’re experiencing financial losses.

- Prioritize the leaks with the biggest financial impact first: You can likely identify several instances of revenue leakage with multiple causes. In this case, start by solving the biggest leaks first.

- Test your hypothesis: Audit the department to determine potential issues. An audit may include gathering and analyzing data from software programs or interviewing staff.

- Implement solutions that address the audit findings: Once you identify the problems, fix them. Depending on the problem, this may require training your care team, implementing new processes, or investing in a software solution.

Let’s look at an example from a senior living community.

You run your financial reports and notice your revenue from care services is lower than the previous month despite having a higher occupancy rate. You realize you’ve had some turnover with your care staff, so you hypothesize that’s the discrepancy source.

Your team audits care records and interviews the care staff and discovers many new hires were improperly documenting care events and, in some cases, forgetting to update patient charts altogether.

In talking with your staff, you discover that their managers rushed their training because they needed the extra staff on the floor quickly. Therefore, your new hires find the data entry system confusing.

The revenue leakage occurred because billable care events never made it into documentation, which meant your coding and billing teams didn’t know they occurred. To correct the problem, you invest in a better care software program that makes documentation more intuitive and timely. You also require extensive documentation training.

This is a simplified scenario, so be prepared to find that your hypothesis doesn’t pan out how you thought. You may need to audit a different department or process and then discover that multiple departments or processes caused the issue.

How to Prevent Revenue Leakage

The most efficient way to eliminate revenue leakage is to prevent it before it starts. Fortunately, you can easily solve most senior living revenue leakage problems with automated software systems and better staff training.

- Invest in an unified data system: From sales and marketing to accounting and billing, invest in a complete software solution built specifically for the unique needs of senior living. These systems provide unparalleled automation, reporting, and predictive analytics to help you provide the best care while maximizing your revenue stream and improving oversight across every aspect of your community.

- Audit and monitor coding, documentation, and data entry processes: Don’t wait for a discrepancy to show up months after the fact. Be proactive with regular audits of processes that often lead to revenue leakage.

- Educate your staff: New hires aren’t the only ones who need training. Even experienced staff benefit from refresher training whenever a process changes.

- Negotiate favorable payor and provider contracts: Be proactive with your payors and providers. Watch out for rising costs and negotiate to secure the best deals, which allows you to charge your residents in line with industry standards.

Share cost estimates with residents and their families upfront. Be open about potential out-of-pocket costs. If that means your community doesn’t fit their budget, you may lose a prospect or resident, but it protects your long-term revenue if you end up providing services they can’t afford.

Plug Revenue Leakage for Good With Aline

The senior living industry has no shortage of challenges. Fortunately, the right software solution can put actionable information and automated solutions at your fingertips — and Aline is that solution. Book an Aline demo today to start streamlining your workflow and protect your cash flow.

Related Content

Blogs, stories and studies from the forefront of senior living operations

Improve Cash Flow and Efficiencies With New Aline Payments

Aline Payments takes the burdens out of payment processing, so you optimize your revenue potential.

Aline vs. ALIS: A 2024 Comparison Guide

Discover why Aline is the number one senior living software option.

Aline vs. WelcomeHome: A Side-by-Side Comparison for 2024

Learn why Aline is a more complete software solution.

5 Strategies for Increasing Resident Retention and Engagement

Improve your senior living community’s long-term growth potential with better resident retention and engagement.

Aline Benchmark Report Update: Highlights From Q2 2024

Get the latest senior living sales and marketing data to improve your performance with the Aline Benchmark Report Q2 2024.

What’s in a Name — Aline CRM: Everything You Need to Know

Aline announces product name changes for its suite of senior living software solutions to simplify the user experience.