Identifying and Preventing Senior Living Revenue Leakage

Avoid revenue leakage by stopping it before it starts.

Avoid revenue leakage by stopping it before it starts.

Published on: June 21, 2024

Last updated: May 22, 2025

As operators, you face so many different sources of revenue stress — inflation, staff turnover, and supplemental payor challenges — but senior living revenue leakage can be especially costly in a time when many communities are already struggling.

According to the latest Polsinelli-TrBK Distress Index, health care-related Chapter 11 bankruptcy filings are increasing in 2024. According to the report, the health care distress index is more than 800% higher than it was in 2010, and senior living communities are feeling “intense stress.”

To get ahead of revenue leakage, you need a proactive approach to identifying common causes and the right solutions in place to immediately address those issues. Stopping revenue leakage before it starts is key to protecting your portfolio’s growth.

Senior living revenue leakage is money your senior living community has earned but lost, either by not collecting the funds or spending your budget on avoidable costs, such as replacing staff or fighting denied claims.

Think of your revenue stream as a pipe. Potential earnings slip away when revenue leaks, like water in a dripping pipe. As a senior living operator, it’s your job to patch those leaks to maximize revenue and reinvest those earnings into your communities to enhance your residents’ experiences and attract new prospects.

If you don’t patch revenue leakage holes quickly, you can face cash flow problems. With limited cash flow, you may have to limit services, which can make you unpopular with residents, or you may have to take out high-interest loans to cover the gap without affecting residents.

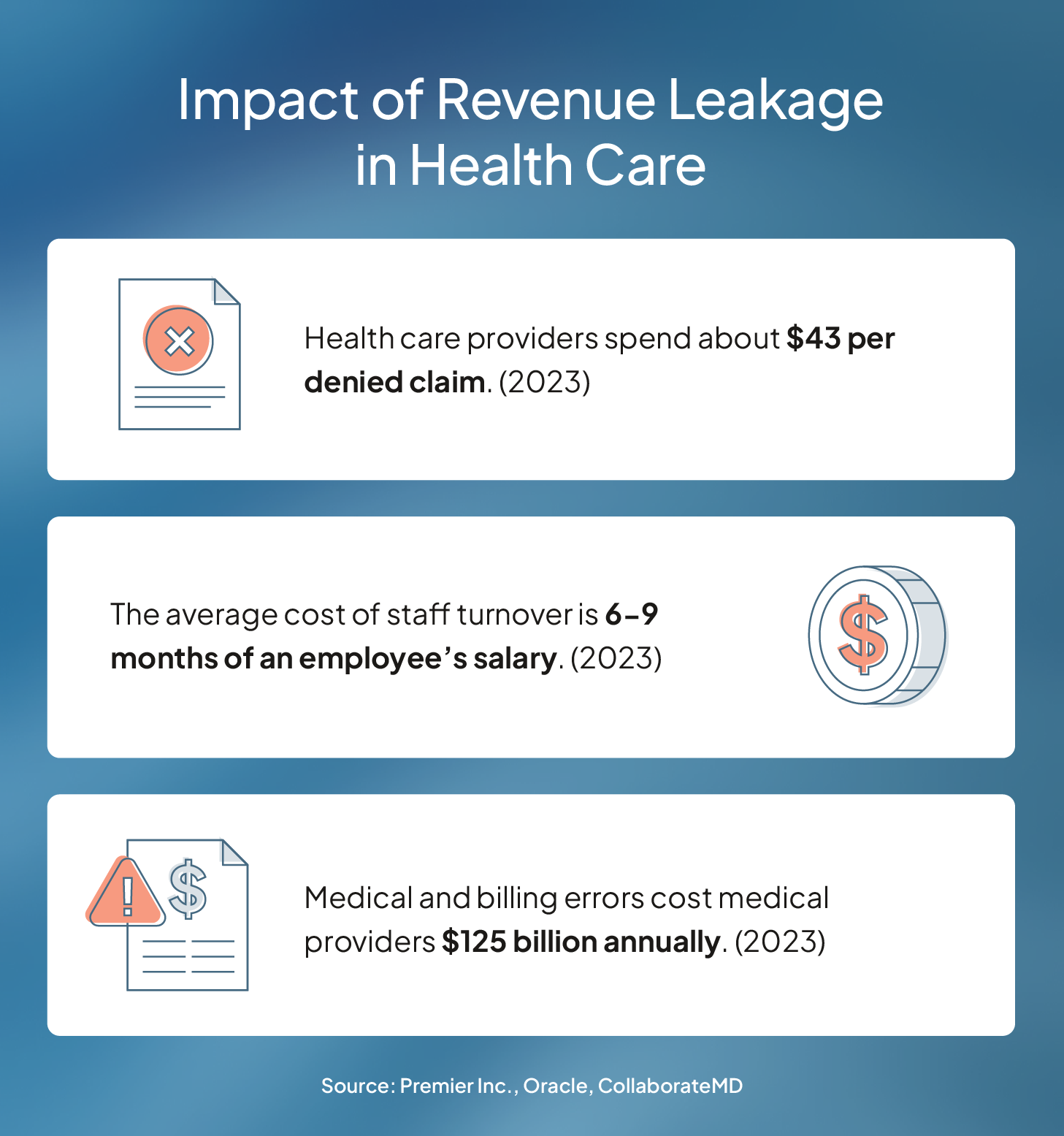

You can’t afford to ignore revenue leakage. According to McKinsey and Company, revenue leakage in health care costs $300 million annually. By nature, this is unseen revenue loss, so it’s important to catch these issues before these numbers creep into your revenue reports.

Here are the most common causes to look for in your senior living community.

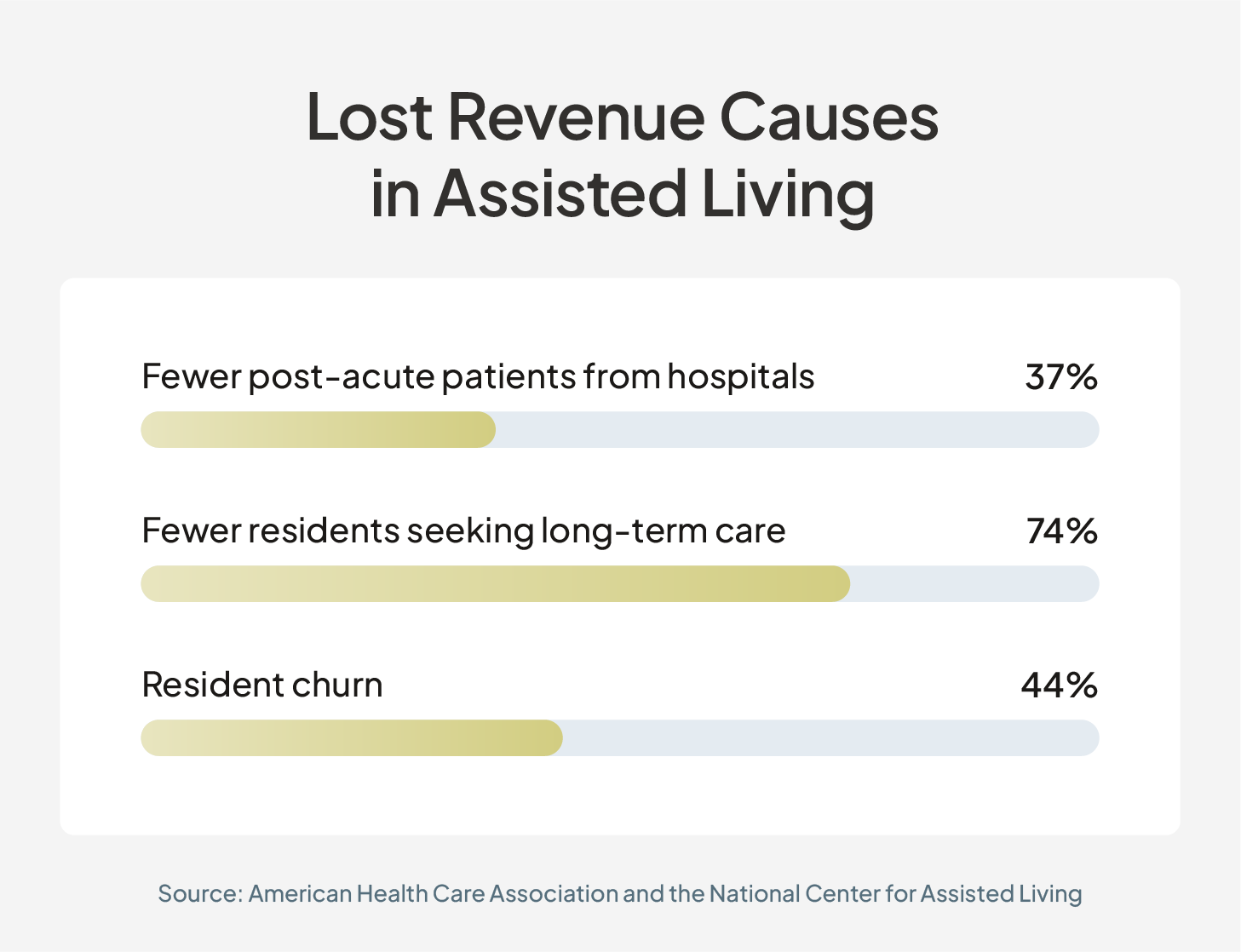

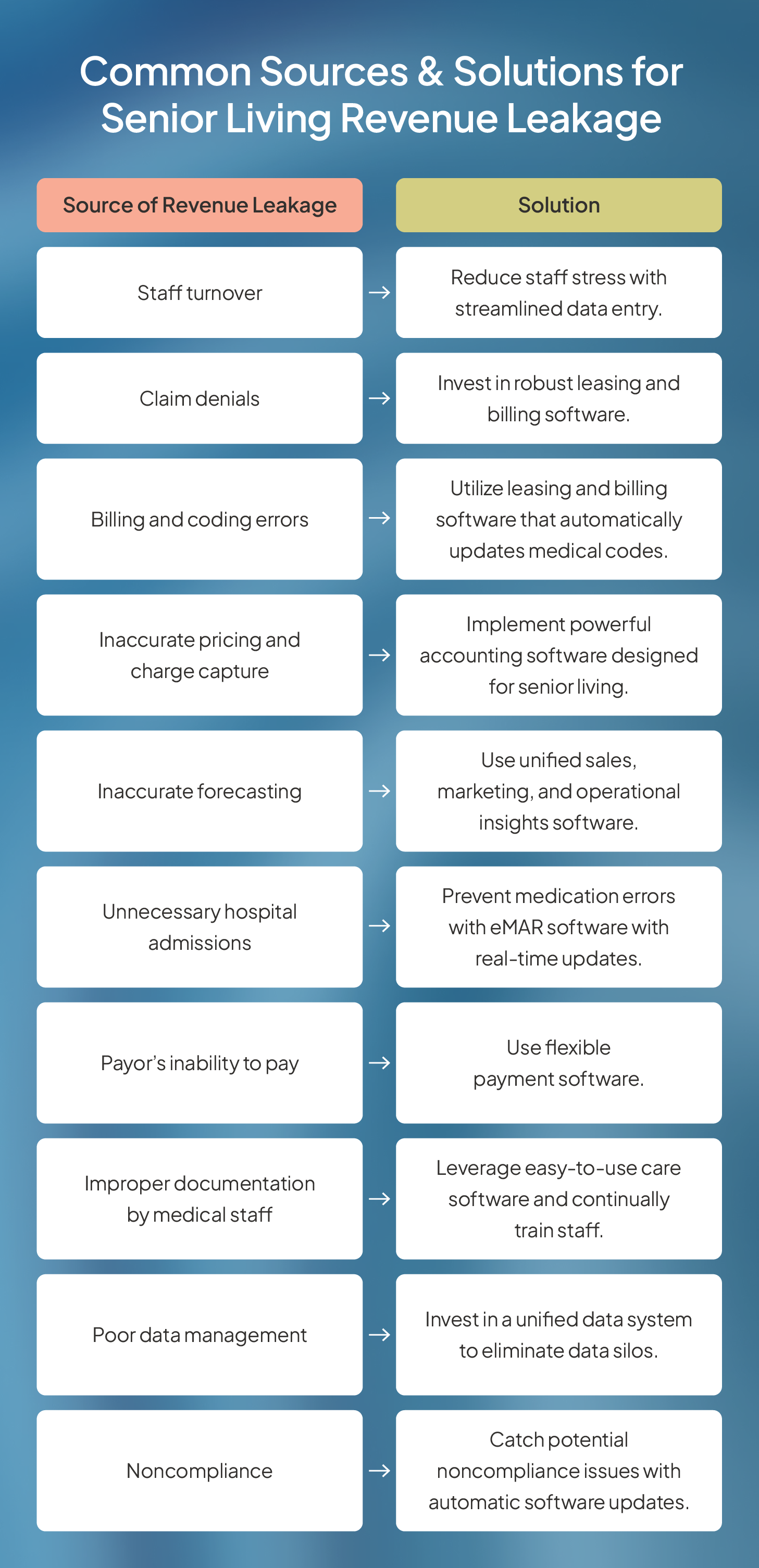

High turnover rates have long troubled the senior living care industry with some assisted living statistics suggesting it’s as high as 50%. This presents a potentially huge revenue leak for operators, making employee retention a top priority.

Staff turnover contributes to revenue leakage in several ways:

| Success tip: Be proactive about minimizing staff stress, a main cause of turnover. Streamlined care software with real-time updates synchronizes your team, ensuring consistent and informed communication across all members. This advanced technology also minimizes time spent charting, so your care staff can focus on providing high-quality, personalized care rather than data entry. |

Claim denials aren’t just bad for your residents — they also hurt you. In fact, 76% of health care financial leaders list managing claim denials as their most time-consuming revenue cycle task. A Premier study found that private payors deny roughly 15% of claims. Fortunately, more than half of those were eventually overturned, but it costs providers about $43 per claim to fight.

When insurance companies deny claims, the resident must take on the cost. But most seniors are on limited budgets. They either need a payment plan, which reduces cash flow, or they can’t pay back the denied claim.

| Success tip: Invest in leasing and billing software designed specifically for senior living communities that catch billing and coding errors before sending claims. This software also automates the bill collection process and stay on top of prior authorization requirements. |

Billing, coding, and accounting errors are one of the biggest causes of claim denials, accounting for 42% of all claim denials, according to an Experian survey. Some medical codes are updated annually while others are updated more frequently, which can create confusion for your medical billing and coding team.

| Success tip: Train your billing and coding staff frequently on coding updates to eliminate these costly errors. You can also invest in billing software that automates coding updates to flag errors early in the process. |

To remain competitive, you have to price your community competitively. Too high, and you risk losing residents to more affordable communities. Too low, and you can lose valuable revenue to adequately care for your residents.

With senior living rent rate increases occurring every year and rate hikes varying by acuity level, finding the balance is tricky, especially if you have multiple acuity levels in your portfolio.

Add in evolving pricing for medical care and the potential for charge capture errors and it’s easy to see how you could be hemorrhaging revenue without realizing it.

| Success tip: Implement senior living accounting software that allows you to pull reports on pricing and compare them to industry standards to ensure your rent increases are on par with your area. |

Accurate forecasting is crucial in senior living management.

Without a precise understanding of future demand, poor decisions can lead to unnecessary renovations or expansions, which directly reduces your profit margins. Similarly, incorrect staffing forecasts not only affect operational effectiveness but can also significantly inflate costs and lead to poor financial performance.

The reliability of every decision hinges on the quality of the data behind it. If you turn to inaccurate forecasting data, expect to make misguided decisions as well. This can result in overstaffing, improper resource allocation, or unprofitable investments — all of which directly impact your bottom line and lead to significant revenue leakage.

| Success tip: Accurate, real-time updates are essential for every senior living operator. By integrating your sales and marketing data with operational insights software, you can make the right decisions to help your community become more competitive. Ultimately, those investments help enhance resident satisfaction to increase occupancy and their lengths-of-stay for more sustainable revenue growth. |

Hospital admissions and readmissions not only increase direct care costs but also lead to lost revenue during resident hospital stays.

Communities with high readmission rates, for instance, may face penalties and reduced reimbursements from insurers, including Medicare. These frequent hospitalizations can even result in higher insurance premiums and more rigorous claims scrutiny, complicating reimbursement processes and impacting overall financial stability.

| Success tip: A powerful eMAR system can prevent many hospital admissions and readmissions. This software updates in real time and provides medication reminders and prevents medication errors, which affect 27% of patients in senior living. |

As a senior living owner and operator, you know your residents have limited incomes. The annual median retirement income in 2023 was about $50,000, yet the average cost of assisted living is $4,500 a month. As a result, many seniors cannot afford their medical bills.

Even with insurance, roughly four million adults over 65 report having medical-related debt. This is money you’ve made but haven’t collected.

| Success tip: Offer residents automated, flexible payment systems. Since so many seniors live on fixed incomes, family members often help with the bills in full or partial payments. A system that allows for multiple family members, such as several siblings, to easily split monthly payments helps close the gap on missing funds and reduces the time your staff spends tracking down overdue charges. |

Your staff is human and makes mistakes. Improper documentation can happen. Unfortunately, those mistakes may put residents at risk and potentially cost you.

As your medical staff documents a resident’s care, the coding team translates the medical documentation to medical codes. The billing team then uses those codes to create invoices sent to payors. If there’s a mistake during any step of the process, your coding and billing team may not catch it.

| Success tip: Leverage easy-to-use senior living resident care software with real-time updates to keep everyone informed on each resident’s current acuity level without hours of charting. Continually train your care staff on best practices for documentation. |

One of the biggest examples of poor data management in senior living communities is related to acuity creep. Acuity creep occurs when a resident loses the ability to live at their current level of care.

For example, a resident may fall and require guided assistance until they heal. However, that change in care — and its related costs — isn’t automatically communicated to billing unless a unified system is in place. As a result, you end up providing more expensive care without billing for it, which could go undiscovered for months.

| Success tip: To remain objective in their assessments, caregivers aren’t involved in billing, but the back office still needs to immediately record any new changes in care. Ensure your tech stack automatically communicates care changes to give the billing team the correct rates while allowing the care team to provide appropriate care. |

The senior living industry is constantly evolving with changes to medical treatments, medical codes, insurance billing practices, and laws and regulations. These fluctuations leave the potential for noncompliance wide open unless you stay on top of these changes day to day and communicate any changes to your staff.

Noncompliance has the potential for expensive repercussions. Not only is it dangerous for your residents but it can also leave you open to costly fines and potential lawsuits. Even one noncompliance event can harm your reputation if a resident or family member mentions it in an online review, which could harm your lead pipeline for future occupancy growth.

| Success tip: Senior living operations software can help you stay on top of compliance issues — from medication administration to resident care. Some software can flag noncompliance with real-time alerts to always keep your team in compliance. |

In the past, identifying revenue leakage involved in-depth, time-consuming data analysis across all your platforms. However, software can do much of this analysis easily and instantaneously.

To identify revenue leakage in your senior living portfolio, follow these steps.

Let’s look at an example from a senior living community.

You run your financial reports and notice your revenue from care services is lower than the previous month despite having a higher occupancy rate. You realize you’ve had some turnover with your care staff, so you hypothesize that’s the discrepancy source.

Your team audits care records and interviews the care staff and discovers many new hires were improperly documenting care events and, in some cases, forgetting to update patient charts altogether.

In talking with your staff, you discover that their managers rushed their training because they needed the extra staff on the floor quickly. Therefore, your new hires find the data entry system confusing.

The revenue leakage occurred because billable care events never made it into documentation, which meant your coding and billing teams didn’t know they occurred. To correct the problem, you invest in a better care software program that makes documentation more intuitive and timely. You also require extensive documentation training.

This is a simplified scenario, so be prepared to find that your hypothesis doesn’t pan out how you thought. You may need to audit a different department or process and then discover that multiple departments or processes caused the issue.

The most efficient way to eliminate revenue leakage is to prevent it before it starts. Fortunately, you can easily solve most senior living revenue leakage problems with automated software systems and better staff training.

Share cost estimates with residents and their families upfront. Be open about potential out-of-pocket costs. If that means your community doesn’t fit their budget, you may lose a prospect or resident, but it protects your long-term revenue if you end up providing services they can’t afford.

The senior living industry has no shortage of challenges. Fortunately, the right software solution can put actionable information and automated solutions at your fingertips — and Aline is that solution. Book an Aline demo today to start streamlining your workflow and protect your cash flow.

Amanda McGrory-Dixon

Amanda McGrory-Dixon is the content marketing manager at Aline, where she shares expert insights on how senior living communities can streamline operations, enhance resident satisfaction, and drive sustainable growth. With a deep understanding of industry trends and technology, she helps operators navigate challenges and implement data-driven strategies to improve efficiency, profitability, and care outcomes.

Blogs, stories and studies from the forefront of senior living operations

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Prospect-centered selling helps senior living operators convert more leads and achieve occupancy goals through a more personalized, empathetic approach.

Gain insight into senior living pricing strategies for community success. Explore how Aline’s software optimizes revenue and operations

Overcome the biggest senior living financial challenges, including operational costs and occupancy rates, with interconnected software

Take a look at how senior living software options, like Aline, can elevate operations, resident care, and ROI

Enhance efficiency, accuracy, and resident satisfaction by integrating a POS system into your senior living dining operations

We’re using cookies on this site to improve your experience. Cookies help us learn how you interact with our website, and remember you when you come back so we can tailor it to your interests.

You can find out more about cookies and usage on our cookie policy page.

Some of these cookies are essential, while others help us to improve your experience by providing insights into how the site is being used.

For more detailed information on the cookies we use, please check our privacy policy

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Aline Innovation Summit 2026: Registration Now Open!

Connect with senior living leaders, innovators, and industry peers May 11-13, 2026, in Frisco, TX to explore the latest innovations, proven strategies, and best practices shaping the future of senior living. View details and register today.