Senior Living Community Revenue Cycle Management [+4 Tips for Success]

Discover how billing & accounting software streamlines revenue cycle management.

Discover how billing & accounting software streamlines revenue cycle management.

Published on: May 20, 2024

Last updated: September 4, 2025

Contents

Revenue cycle management is a complex process for any organization, especially those in the senior living industry. Changing regulations, an extended payment cycle, and increasing claim denials can make senior living community revenue cycle management one of operations management‘s biggest headaches.

Fortunately, accounting and billing software can make the process more efficient, allowing you and your team to focus on providing excellent care rather than being chained to a complex billing entry system.

Read on to learn the ins and outs of successful revenue cycle management, including tips for success.

Senior living revenue cycle management is a financial process senior living operators use to track patient care, billing, and collections. The goal is to manage the cycle, so you receive payment in full as quickly as possible to improve your revenue stream and cash flow.

Because this process is complex, senior living management often uses software to tackle the myriad of administrative and clinical functions involved.

Revenue cycle management is imperative to the success of your senior living community. It allows you to quickly:

Revenue cycle management has always been an important factor in the success of a senior living community.

The recent transition to value-based health care has made it more challenging. In value-based care, insurance companies don’t automatically approve every service your medical staff provides, increasing the administrative burden for your billing team through additional documentation and increased claim denials.

Bottlenecks and breakdowns can occur at several places in the revenue cycle, increasing the time it takes to receive payment. For example, suppose your care team moves one of your residents to a higher acuity level. If this change isn’t automatically reflected in their billing, you could miss that additional payment in the next revenue cycle.

The key to successful revenue cycle management is data, which means you need robust billing and accounting software for the right insights.

In an ideal world, your team executes every step in the revenue cycle perfectly. Unfortunately, your team doesn’t have control of some aspects of the cycle, which can cause breakdowns that slow the process and negatively impact your bottom line.

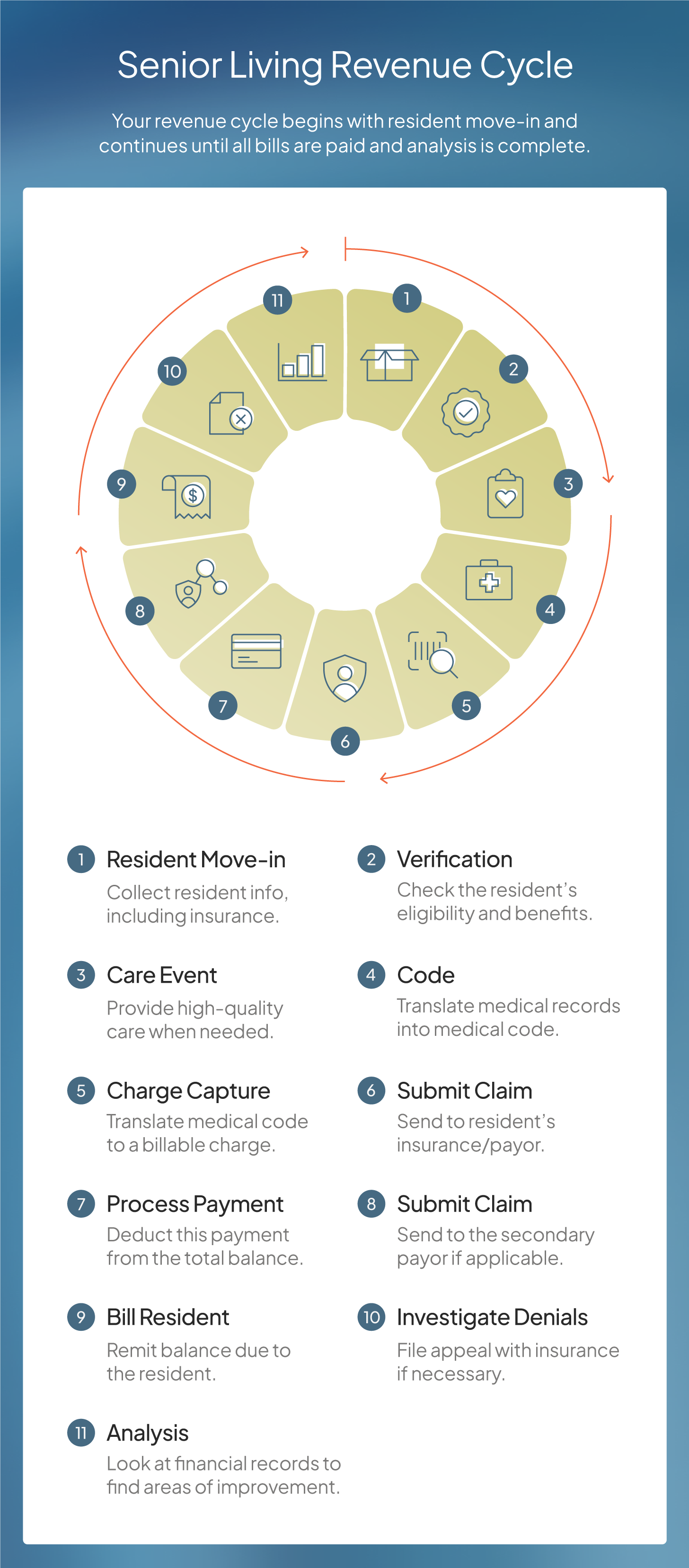

For maximum efficiency and success, follow these 11 steps.

No matter the acuity level, the revenue cycle begins when a prospective resident signs the paperwork to officially move in and become a resident of your senior living community.

Automate as much of this administrative process as possible. Collect all relevant resident information, including crucial administrative data, such as name, birthday, and insurance information. To expedite the process, collect any signatures digitally.

Once you have all that necessary data, schedule the resident’s move-in.

Before the resident moves in, verify their benefits, eligibility, coverage limits, and other key insurance information. You want a clear understanding of what their insurance covers to avoid billing headaches later.

Because policies may change, you’ll want to occasionally reverify residents’ insurance information.

Depending on the level of care in your community, you may need to provide medical and other resident care that requires additional billing beyond the monthly rent.

For example, an assisted living community may only need to provide occasional doctor consultations and medications while skilled nursing communities may need to provide physical therapy or regular blood draws.

Your medical team also needs to document these care events in resident care management software and an eMAR system. This ensures the billing team has a record of the care event and your entire care team is on the same page.

Once the medical team documented the care provided, the revenue cycle management process transfers from the care team to the medical coding team. Medical coders are responsible for translating the diagnoses, procedures, medications and other treatments into a standard code, such as CPT, ICD-10-CM, or HCPCS Level II.

After medical coders have translated the medical records into medical codes, the billing team takes over. They’re responsible for translating the medical code into billable charges.

Charge capture may seem like an extra step, but it helps you identify revenue leakage. The more precise and complete your charge captures, the more optimized your workflow.

After completing and verifying the charge capture, your billing team submits the bill for care to your resident’s insurance provider or government payors, such as Medicare and Medicaid.

If the resident has multiple coverages, such as Medicare and private insurance, your billing team needs to submit the bill to the primary payor identified by the resident.

Insurance companies typically have 30 days to review and pay the bill. Once they remit payment, your billing team should update payment records.

It’s important to quickly process the payment, so your ledgers are accurate. Processing the payment quickly also allows you to move to the next step of the process if the insurer or government payor doesn’t cover the entire cost of the provided care.

After the primary insurance pays its share of the bill, the billing team should submit the remaining balance to any secondary or tertiary payors. The billing team then processes and records the payment.

After sending the bill to all applicable payors, your billing team remits any outstanding balance to the resident. Typically, the resident has 30 days to pay the balance, but depending on their situation and your policies, they may opt for a payment plan to help them pay their bill in full over time.

If a payor denies the claim, your billing team reviews their reasoning. They may find a claim mistake, such as the medical coding team using an incorrect billing code, and initiate the appeals process.

Analyze your revenue data for insights to guide your business decisions. Software programs, such as Aline, can easily pull data related to your revenue performance into various helpful reports for you and your stakeholders.

These customizable reports help you:

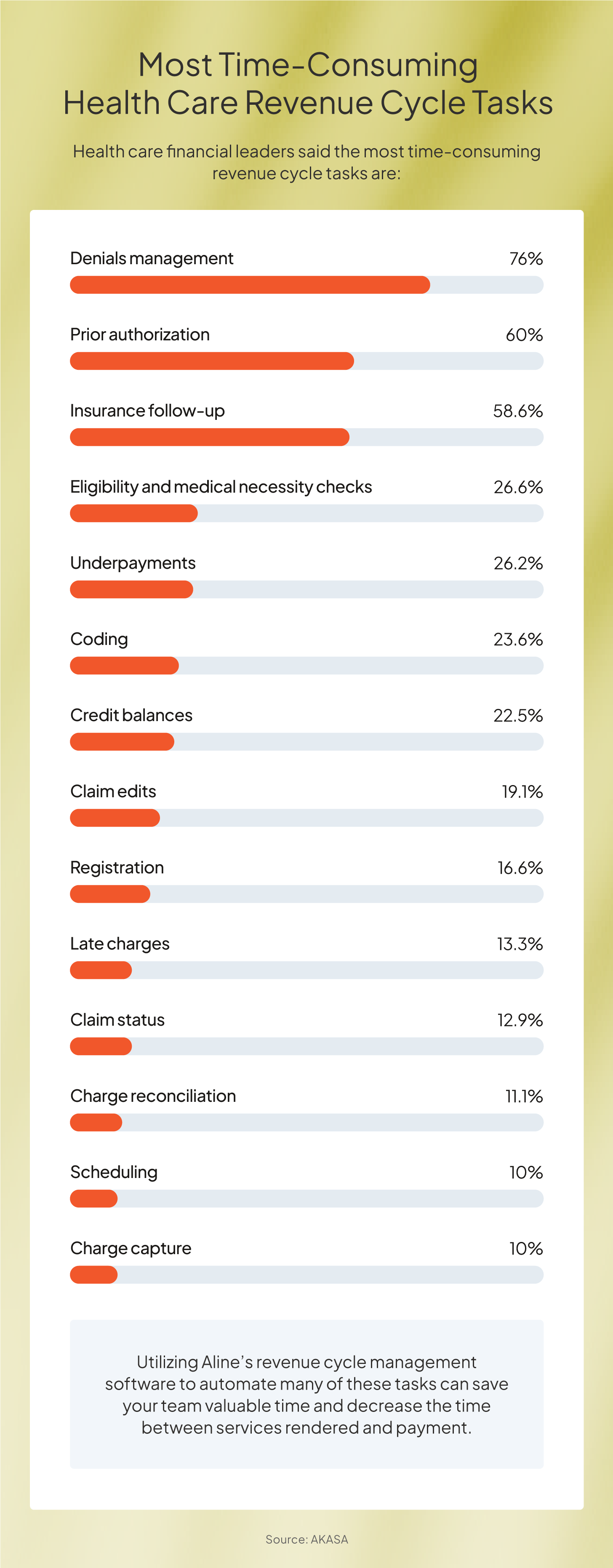

Senior living revenue cycle managment is often one of the key revenue challenges for various reasons, including rapidly changing policies and decision-making bottlenecks.

Senior living revenue cycle management optimizes your revenue stream and strengthens your overall financial stability.

Here are a few reasons to automate your revenue cycle management using senior living financial management solutions, like Aline:

While challenging, senior living revenue cycle management can be done effectively with the following tips.

A recent study shows the most common reasons for claims denials are:

A revenue management software program built specifically for the senior living industry can catch these errors before claims are sent to insurance and government payors. Not only does this increase the likelihood of acceptance and payment but it also prevents you from wasting time and money on appealing claim denials.

Unfortunately, the same study found that claim denials are increasing, a problem for providers. Each claim costs roughly $44 to appeal, which wastes money when the appeal is due to a clerical error that could have been caught before the bill was sent to insurance.

Giving residents access to their resident care profiles at the start of the revenue cycle can help reduce some errors. For example, asking residents to validate their insurance before a care event can ensure you have the most accurate insurance and government payor information.

You can also allow residents to store credit card information and make payments directly in the software so they can pay when convenient. Keep the revenue management cycle moving forward by empowering your residents to easily update data and pay bills with billing and accounting software.

Automate some or all of the coding and billing processes with senior living billing software, helping your team work more efficiently. For example, Aline’s software suite recognizes when a care team member changes a resident’s level of care and automatically updates their billing information, preventing potential revenue leakage instantly.

Easily track claim statuses, manage claim denials, and see trends with specific residents, providers, or care events with coding and billing software. This frees up your billing team to focus on processing new claims instead of following up on existing claims and appealing claim denials.

Data is essential to better resident care, especially as the medical community transitions to more value-based care than fee-for-service care. The data from billing and accounting software is a key metric to identify areas of your business that need improving. Easily-generated reports increase your bottom line while also improving patient care and satisfaction.

Managing your senior living revenue cycle can be overwhelming, but the benefits far outweigh the challenges. Fortunately, senior living software solutions, such as the Aline software suite, can make senior living revenue management cycle easier for your team.

Whether you want to explore Aline Leasing & Billing and Aline Accounting by Sage, or you want to explore the entire suite to streamline every aspect of your business, book a demo today. And learn more about how you can stop revenue leakage with our detailed guide “Senior Living Operators: Better Manage Revenue Workflows With Integrated Data.”

Amanda McGrory-Dixon

Amanda McGrory-Dixon is the content marketing manager at Aline, where she shares expert insights on how senior living communities can streamline operations, enhance resident satisfaction, and drive sustainable growth. With a deep understanding of industry trends and technology, she helps operators navigate challenges and implement data-driven strategies to improve efficiency, profitability, and care outcomes.

Blogs, stories and studies from the forefront of senior living operations

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Prospect-centered selling helps senior living operators convert more leads and achieve occupancy goals through a more personalized, empathetic approach.

Gain insight into senior living pricing strategies for community success. Explore how Aline’s software optimizes revenue and operations

Overcome the biggest senior living financial challenges, including operational costs and occupancy rates, with interconnected software

Take a look at how senior living software options, like Aline, can elevate operations, resident care, and ROI

Enhance efficiency, accuracy, and resident satisfaction by integrating a POS system into your senior living dining operations

We’re using cookies on this site to improve your experience. Cookies help us learn how you interact with our website, and remember you when you come back so we can tailor it to your interests.

You can find out more about cookies and usage on our cookie policy page.

Some of these cookies are essential, while others help us to improve your experience by providing insights into how the site is being used.

For more detailed information on the cookies we use, please check our privacy policy

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Aline Innovation Summit 2026: Registration Now Open!

Connect with senior living leaders, innovators, and industry peers May 11-13, 2026, in Frisco, TX to explore the latest innovations, proven strategies, and best practices shaping the future of senior living. View details and register today.