Health Care Payors: Navigating Successful Senior Living Partnerships

Navigate the complexities of health care payors for successful revenue management, streamlined operations, and successful partnerships

Navigate the complexities of health care payors for successful revenue management, streamlined operations, and successful partnerships

Published on: July 1, 2025

Last updated: September 12, 2025

Payor relationships play a pivotal role in the financial and operational health of senior living communities. From reimbursement workflows to service eligibility, the way operators engage with health care payors directly influences both bottom-line performance and resident care delivery. With 86% of operators now relying on financial platforms, according to Aline’s 2025 State of the Industry Report, operators are under increasing pressure to engage payors more strategically, prioritizing clarity, compliance, and stronger financial oversight.

Strengthening payor engagement has become essential for maintaining financial health and meeting the expectations of residents, families, and care partners. To do that effectively, operators need a clear understanding of how payors function, what they prioritize, and how to align community operations with their processes.

As trends in senior living emphasize personalized care and resident well-being, strong operational management is essential. That includes understanding the key health care payors shaping how services are accessed and reimbursed.

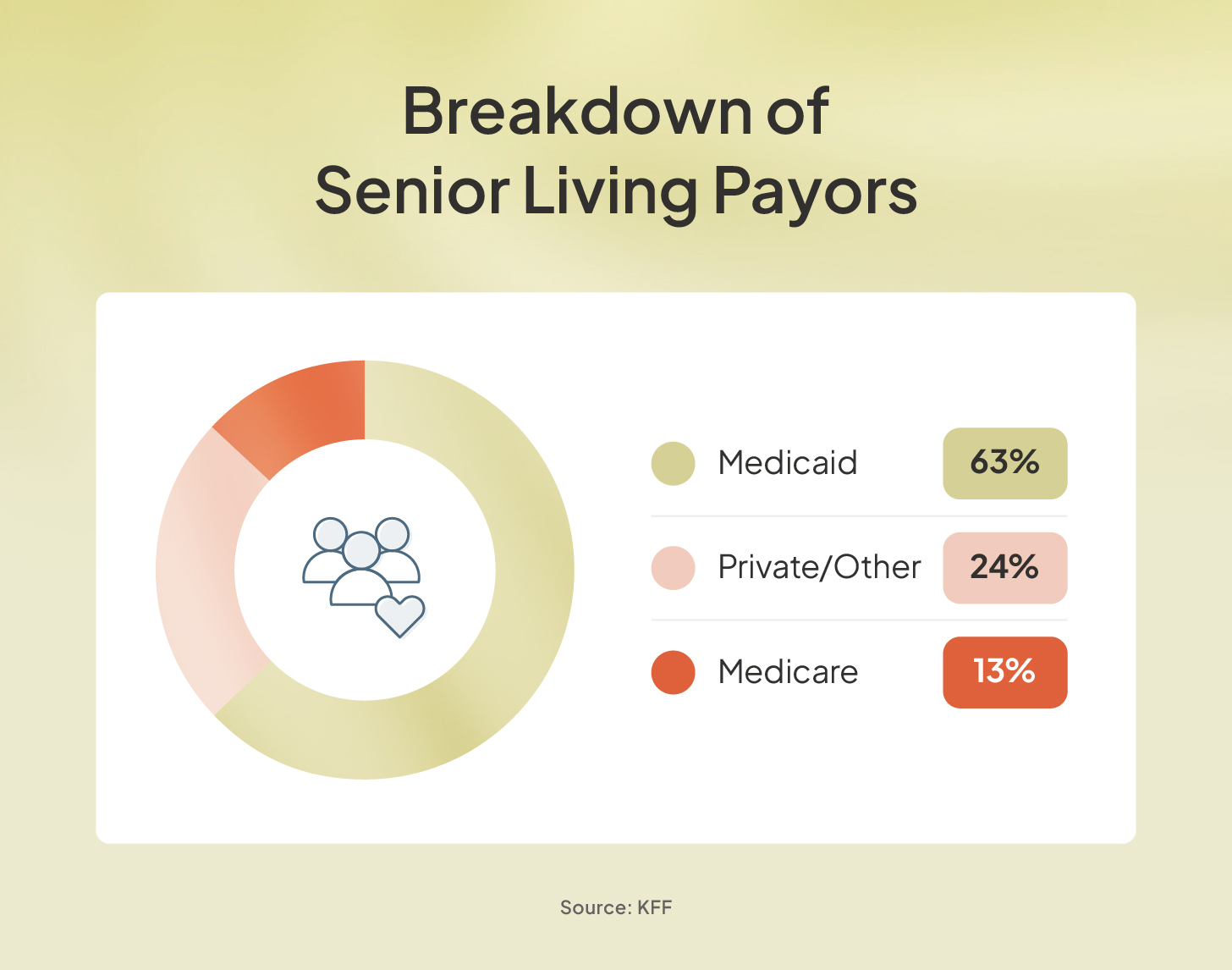

The graphic below highlights the main types of payors and examples of each to help guide more effective partnerships.

Government health care payors include publicly funded insurance programs that help cover certain medical and personal care expenses in senior living. The three most relevant programs for operators are Medicare, Medicaid, and the Department of Veterans Affairs (VA).

Here’s how each payor typically works with senior living communities:

Commercial health care payors include private insurance companies and value-based care entities. Individuals typically pay for this coverage through premiums, but what’s covered, especially within senior living, can vary widely by provider and plan.

Most commercial insurance plans do not cover room and board in senior living communities. However, some offer long-term care insurance policies that may help offset the cost of personal care services or support.

Another increasingly relevant type of commercial payor is an accountable care organization (ACO). ACOs are groups of physicians, hospitals, and other health care providers, sometimes including senior living communities, that collaborate to deliver coordinated, high-quality care.

By aligning with ACOs, senior living communities may gain access to preferred provider networks, shared savings models, and more seamless integration into the broader health care system. These partnerships often focus on value-based care, helping communities improve outcomes while controlling costs.

Managed care organizations (MCOs) are health care payors that aim to control costs while ensuring high-quality care through structured provider networks. These networks often include senior living communities and consist of plan types such as health maintenance organizations (HMOs), preferred provider organizations (PPOs), and point-of-service (POS) plans.

When a senior living community participates in an MCO’s network, it may benefit from more consistent resident referrals for services, like assisted living, memory care, and chronic condition management. MCOs often contract directly with communities to provide care to members, focusing on reducing hospital readmissions, coordinating transitions of care, and supporting long-term wellness.

Private payors are residents or their families who pay out of pocket for care and services. In many senior living communities, private payors represent a substantial share of total revenue, making them a key financial stakeholder.

Unlike third-party payors, private-pay relationships are direct and personal, which makes communication, transparency, and satisfaction critical to long-term retention. Communities that rely heavily on private payors must consistently meet their expectations — both in service quality and the payment experience.

To ensure both financial strength and high-quality care, senior living operators must approach health care payor relationships with intention and clarity. As payor engagement becomes more complex, aligning operational strategies with financial insight and understanding the expectations of different payor types is essential.

Effective collaboration with payors requires more than submitting claims or invoices. It involves building proactive, compliant partnerships that support long-term sustainability and resident well-being.

Here are five key areas senior living leaders should prioritize.

Managing payor relationships in senior living is complex, especially when a single resident may be supported by multiple payors, each with different coverage rules and reimbursement processes. Without the right tools, administrative and billing teams can struggle to stay organized and compliant.

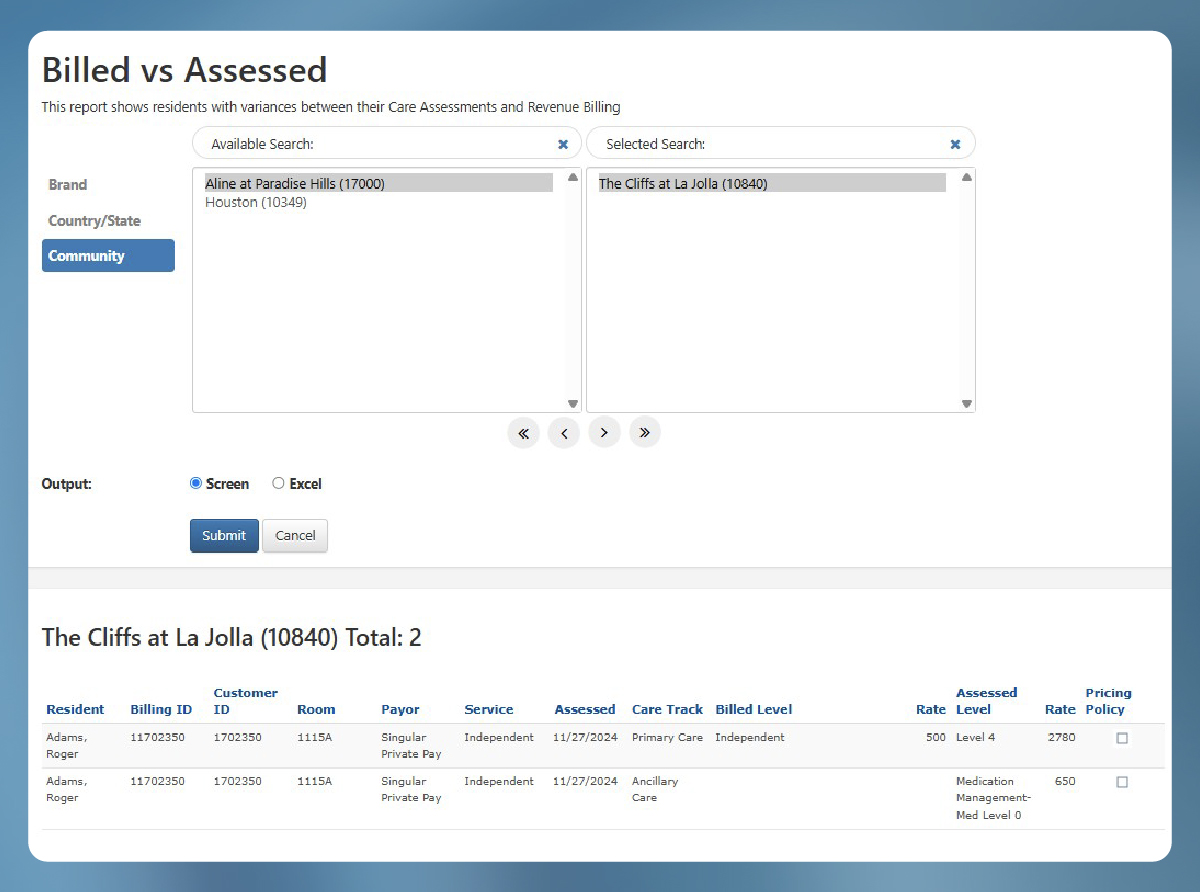

Technology offers a smarter, more scalable way to manage this complexity. Solutions, like Aline Leasing & Billing, are designed specifically for senior living operators, making it easier to track and coordinate payor data at the individual resident level.

By integrating leasing information with billing workflows, communities can streamline financial management, ensure accurate documentation, and improve communication with both residents and payors. The result is better revenue cycle performance and more time for your team to focus on more strategic initiatives.

Here are some of the key ways leasing and billing software can support your community.

Verifying a resident’s eligibility ensures they have active and valid coverage with a specific health care payor at the time services are provided. This essential step helps prevent denied claims and protects your community from potential revenue loss by confirming reimbursement eligibility upfront.

Aline’s software streamlines the eligibility process with real-time verification checks, automated reminder workflows, and a centralized dashboard to track each resident’s payor status. With greater accuracy and efficiency, your billing team can reduce administrative burdens and accelerate payment cycles.

Accurate billing and timely claims submission are essential for ensuring your community receives proper reimbursement from health care payors. From coding services correctly to submitting claims in the required format, managing denials, and reconciling payments, each step plays a role in securing revenue.

Aline Payments brings automation and accuracy to every stage of this process. The platform generates invoices automatically, tracks payments and claim statuses in real time, and applies late fees and annual rate increases without manual input. By reducing billing errors and streamlining claims workflows, Aline helps prevent revenue leakage and keeps financial operations running smoothly.

Thorough documentation is essential for accurate billing, demonstrating medical necessity, and meeting the requirements of government, commercial, and MCO payors. Clear records of which residents received what care and why help ensure your community remains compliant and reimbursable.

Strong care coordination depends on timely, accurate communication, both within your team and with payor representatives. When everyone has access to the same up-to-date information, it’s easier to avoid missteps, advocate for residents, and ensure claims are supported by clear documentation.

To support this, Aline Payments offers secure messaging portals, unified communication logs, and shared visibility into resident care details. These capabilities reduce friction across teams, minimize inaccuracies, and help keep everyone in sync.

Leveraging data analytics helps transform the relationship between senior living communities and health care payors from transactional to collaborative and value-driven. By tracking key metrics related to resident health, service delivery, and overall community performance, operators can clearly demonstrate the impact of their care.

This data-driven approach not only supports internal quality improvement efforts, but it also strengthens a community’s position in negotiations with payors. Clear, evidence-backed outcomes can lead to more favorable contract terms, deeper partnerships, and increased trust.

Aline’s comprehensive software suite empowers communities with solutions to collect, analyze, and report on critical benchmarks, including resident wellness to service utilization trends. With centralized access to real-time data and reporting, your team can deliver compelling insights to payors when they’re needed most.

Residents of senior living communities are likely reliant on multiple payor types to cover their care and lease services. While helpful for residents, these multiple payor sources can be difficult for senior living community administrative and billing teams to navigate and track.

However, it is crucial for these teams to be successful, so they can provide accurate billing and collection to prevent revenue leakage. Aline accounting software simplifies this task by effectively tracking the appropriate charges from disbursement to collection. The software’s integration helps ensure accuracy and compliance for each resident’s unique financial situation.

Strong partnerships with health care payors are essential to delivering high-quality care and securing your community’s long-term financial health. While managing these relationships can be complex, the right technology makes it easier to navigate requirements, communicate effectively, and ensure accurate, timely reimbursement.

See how Aline’s comprehensive senior living operations platform empowers your team to simplify payor interactions, strengthen billing workflows, and demonstrate value through data. Book a demo today to see how Aline can help your community strengthen its financial performance and simplify the complexities of working with health care payors.

Amanda McGrory-Dixon

Amanda McGrory-Dixon is the content marketing manager at Aline, where she shares expert insights on how senior living communities can streamline operations, enhance resident satisfaction, and drive sustainable growth. With a deep understanding of industry trends and technology, she helps operators navigate challenges and implement data-driven strategies to improve efficiency, profitability, and care outcomes.

Blogs, stories and studies from the forefront of senior living operations

Lead generation surveys give senior living operators the data they need to understand their market, uncover new opportunities, and drive occupancy growth.

Prospect-centered selling helps senior living operators convert more leads and achieve occupancy goals through a more personalized, empathetic approach.

Gain insight into senior living pricing strategies for community success. Explore how Aline’s software optimizes revenue and operations

Overcome the biggest senior living financial challenges, including operational costs and occupancy rates, with interconnected software

Take a look at how senior living software options, like Aline, can elevate operations, resident care, and ROI

Enhance efficiency, accuracy, and resident satisfaction by integrating a POS system into your senior living dining operations

We’re using cookies on this site to improve your experience. Cookies help us learn how you interact with our website, and remember you when you come back so we can tailor it to your interests.

You can find out more about cookies and usage on our cookie policy page.

Some of these cookies are essential, while others help us to improve your experience by providing insights into how the site is being used.

For more detailed information on the cookies we use, please check our privacy policy

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Your experience is important to us. We’re redirecting you to our new Aline website, where you’ll discover how our complete suite of senior living solutions can help you grow occupancy and revenue, optimize operations, and enhance resident care.

For more information, you’re welcome to read our statement on our merger. To continue your web experience, simply close this notification.

Aline Innovation Summit 2026: Registration Now Open!

Connect with senior living leaders, innovators, and industry peers May 11-13, 2026, in Frisco, TX to explore the latest innovations, proven strategies, and best practices shaping the future of senior living. View details and register today.