5 Key Trends From the 2025 State of Senior Living Survey

Explore emerging challenges, growth opportunities, and what’s ahead for senior living operators.

Explore emerging challenges, growth opportunities, and what’s ahead for senior living operators.

Senior living leaders rely on data to spot growth opportunities, adapt quickly, and outperform the competition. From workforce shortages and rising costs to shifting consumer expectations, operators must navigate a constantly in-motion landscape.

That’s why we created the 2025 Aline State of the Senior Living Industry Survey, a data-driven look at the biggest challenges, emerging strategies, and tech trends shaping the future of senior living. Based on insights from senior living leaders across the country, this survey reveals how operators are adapting, what’s working, and where there’s still room to grow.

Below, we pulled five key insights to jump-start your planning. For the full picture — and to see where the industry is heading next — download the complete report.

When asked where senior living leaders see the biggest revenue opportunity in 2025, one theme stood out: operational efficiency.

With rising costs and leaner staffing models, leaders are shifting their focus to process improvement, automation, and eliminating redundancies. The goal? Do more with less without sacrificing the resident experience.

Operators seeing the biggest gains are those investing in integrated tools and real-time performance visibility, such as automated workflows and unifying systems across departments. Efficiency isn’t just about saving time — it’s about building a foundation for scalable, sustainable growth.

Access to data has become one of the biggest differentiators in the industry, but many operators are still flying blind. Only 25% of survey respondents say they have the right data to make informed decisions.

And the rest? They’re dealing with disconnected systems, outdated spreadsheets, and time-consuming reporting. These blind spots make it harder to respond to trends in real time, track profitability, and plan for the future. Operators who close the gap — and leverage platforms that unify financial, operational, and care data — are better positioned to adapt, forecast accurately, and gain an edge.

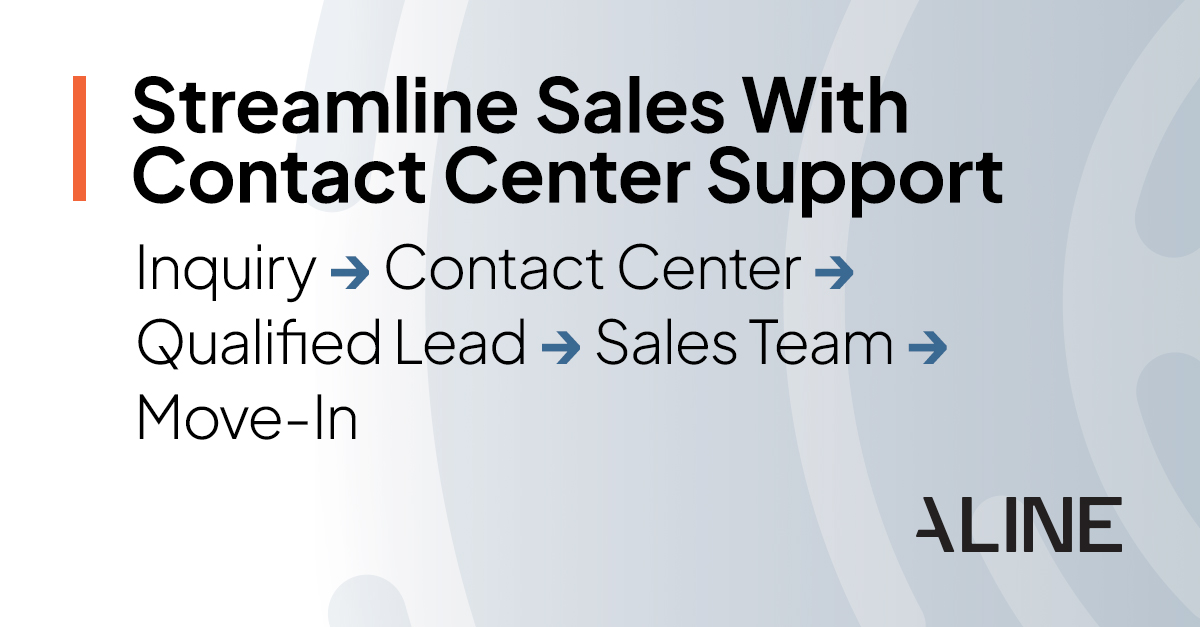

Speed-to-lead remains a top-performing sales strategy, and more operators are turning to contact centers to get there. According to the survey, operators using contact centers not only report faster response times, but they also see higher conversion rates, more tours booked, and stronger prospect satisfaction.

By handling initial inquiries and pre-qualifying leads, contact centers free up sales teams to focus on relationship-building rather than time-consuming administrative work. That early structure also improves consistency and helps deliver a polished, professional first impression, which is often hard to deliver at the community level without a dedicated process for handling inquiries.

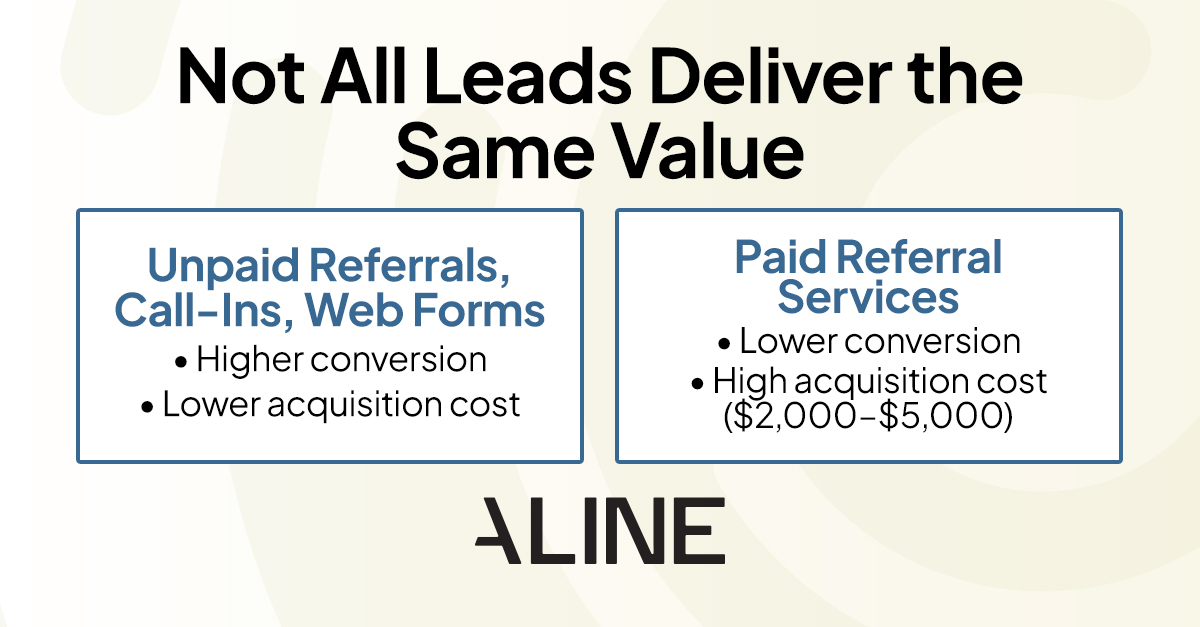

More than 45% of operators say they pay between $2,000 and $5,000 per move-in through paid referral services — but those same leads have the lowest conversion rate of any source.

In contrast, unpaid referrals, call-ins, and web forms convert at significantly higher rates and require fewer touchpoints. This gap is prompting operators to re-evaluate their referral strategy and look for more cost-effective ways to build pipeline.

The bottom line: Not all leads deliver the same value, and operators should think critically about the source of their best opportunities — and what it really costs to close them.

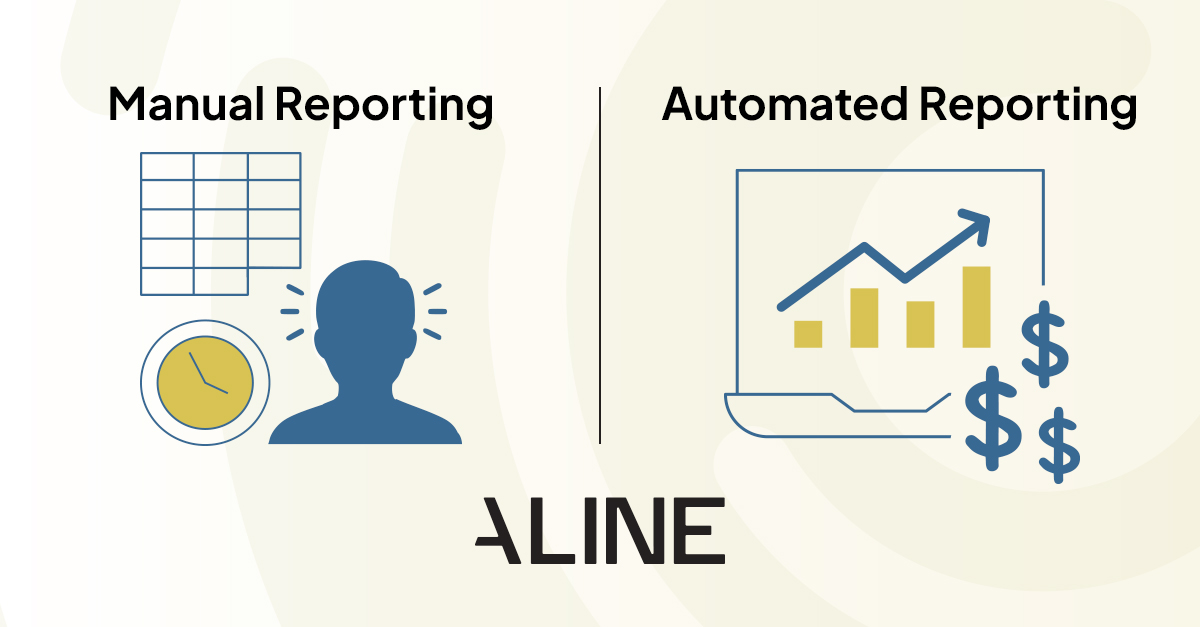

Manual reporting is still surprisingly common in senior living, but that’s starting to change. While 16% of operators still rely entirely on Excel for reporting, a growing number are moving toward fully automated systems that deliver real-time visibility across the business.

Why it matters: Automated reporting helps operators make faster, more confident decisions, especially in areas like cash flow, census, and staffing. It also reduces costly errors and gives leadership teams the necessary agility to adapt when the unexpected happens.

The trend is clear — operators that modernize their financial systems are setting themselves up for better forecasting, stronger performance tracking, and a more resilient bottom line.

The 2025 State of the Senior Living Industry Report includes additional insights — from marketing automation and staffing strategies to financial system adoption and top technology investments.

You’ll learn:

Download your free copy and see how your strategy stacks up.